Summary

Power from shore to replace gas turbines has been the most important measure to reduce greenhouse gas emissions offshore. This report builds on the 2020 report entitled «Power from shore to the Norwegian shelf».

During the period from 2020-2025, the number of fields that have implemented or decided to use power from shore has grown. Transitioning to power from shore has been approved on Sleipner, Njord, Draugen, Oseberg field centre, Oseberg Sør, Troll B and C, as well as the Hammerfest LNG onshore facility. A decision has also been made to develop the fields in the Yggdrasil area using power from shore.

In 2020, there were 16 fields operated entirely or partially using power from shore. When the projects currently under development come on stream, this number will jump to 39. This also includes minor fields tied back to host facilities that operate using power from shore.

Conversion to power from shore has contributed to a significant reduction in greenhouse gases. From 2019 to 2024, emissions from the NCS were reduced by 2.9 million tonnes of CO2-equivalent. Since 2015, the reduction amounts to 4.1 million tonnes of CO2-equivalent, or 27 per cent. Additional emission reductions are expected when all projects currently under development come on stream.

Increased CO2 cost

The most important policy instruments to reduce emissions from the petroleum sector are financial; the emissions trading system and the CO2 tax. The increase in the number of power from shore projects can be attributed to several factors, including higher CO2 costs resulting in more projects becoming profitable.

Since 2020, CO2 costs have increased from around 860 to 1860 Norwegian kroner (NOK) per tonne in 2025. This means that the environmental cost now accounts for a significant share of operating costs for fields operated using gas turbines.

CO2 costs are expected to continue to rise in the years to come.

Several projects halted

The projects which in recent years have been in the planning phase for conversion to power from shore are less profitable and more challenging to implement as compared with green-lighted projects. As a consequence, several projects have been discarded.

Studies are still under way on the Balder and Grane fields in the North Sea. The timing of a potential investment decision is planned for 2026. The Norwegian Offshore Directorate is not aware of any new power from shore projects that are planned/under planning on fields in operation.

The companies have also evaluated alternative solutions to reduce emissions from gas turbines offshore. The companies’ assessment of these alternatives is that the costs are higher, emission reductions are lower, and/or implementation is more technically challenging.

Resource consequences for fields without power from shore

The expectation is that more platforms will continue to operate with gas turbines. Therefore, these platforms will have major greenhouse gas emissions and associated costs.

High CO2 costs can lead to resource-related consequences as this factor can impact the future use of fields as host facilities, accelerate final shutdown timing, influence exploration and reduce the profitability of recovery measures that entail maintaining or increasing energy consumption.

Preface

The Ministry of Energy has tasked the Norwegian Offshore Directorate with updating the platform of knowledge for potential future power from shore projects for existing fields and facilities. Power from shore is described in several earlier reports. The last report was released in 2020.

Mandate for the report

The Ministry of Energy’s mandate for the assignment of establishing an up-to-date platform of knowledge for potential future power from shore projects for existing fields/facilities:

«At several occations, the Norwegian Offshore Directorate has prepared an updated knowledge base linked to power from shore projects on the Norwegian continental shelf. This was most recently done in 2020, and much has taken place in the field since then.

The Ministry has therefore called on the Norwegian Offshore Directorate, in cooperation with the Norwegian Water Resources and Energy Directorate (NVE), with the assignment to prepare an updated knowledge base regarding potential future power from shore projects, cf. Proposition 1 S (2024-2025) Ministry of Energy.

The updated knowledge platform shall include any new power from shore projects which do not already have a decision to concretise, and which are reported by the licensees in the autumn of 2024 («RNB (revised national budget) reporting»).

For projects included in this assignment, consideration shall also be given to the impact on electricity prices, regional power balance and the grid. An assessment shall also be made as to whether potential negative effects can be offset by measures such as increased power generation (incl. gas power plants with CCS (carbon capture and storage)) and grid development. Moreover, the effect of these projects on future greenhouse gas emissions from the sector shall be considered.

The Norwegian Offshore Directorate is also asked to assess potential resource-related consequences for fields/facilities that are not suitable for operation using power from shore.

The work shall be carried out by the Norwegian Offshore Directorate. In those areas which fall under NVE’s scope of responsibility, the Norwegian Offshore Directorate shall obtain assessments from NVE which will be included in what is ultimately delivered to the Ministry. The work shall be summarised in a report in the autumn of 2025.»

This report deals with the development of power from shore projects on fields in operation. Power from shore decisions have been adopted on a number of fields since 2020. This report provides an overview of these fields and discusses projects in the planning phase, and projects where work has been done but which have been discarded for a variety of reasons.

Resource consequences for fields/facilities as a result of the impact of high CO2 costs influencing the companies’ decisions are also highlighted.

Power from shore for potential new developments or conversions to use more power from the grid at onshore facilities does not fall under the scope of this report.

The report shall discuss which effects potential new power from shore projects have on the power system on land. According to the mandate, this shall be done on projects were there is no decision to concretise, and which were reported in the autumn of 2024. There were no such projects in the RNB reporting and the potential impact on the power system is therefore not discussed in the report.

RNB-reporting

RNB reporting is an annual process where, each autumn, the Norwegian Offshore Directorate receives updated information from the operating companies on activities and plans for fields, discoveries, pipelines and onshore facilities.

This is incorporated as a basis for the Norwegian Offshore Directorate’s work to draw up forecasts for the development in the petroleum activities. These forecasts are used as a basis for the work on the revised national budget (RNB), which is presented in May of each year.

The reporting also includes projects for conversion to power from shore.

The first time a project must be reported is after the licensees have made a decision to initiate a project (BOI). After that, the project is reported annually as the project matures and until it comes on stream, or is discarded. The most important milestones for submitting a PDO/PIO (plan for development and operation / plan for installation and operation (Norwegian only)) are:

- BOI – decision to initiate a project entails that the licensees have decided to start work on feasibility studies to identify a technically and financially feasible project.

- BOK – decision to concretise. The licensees have identified a technically and financially feasible concept that provides a basis for starting studies that will lead to a choice of concept.

- BOV – decision to continue. The licensees have chosen a concept and continue to study it with the objective of making an investment decision, i.e. a decision to implement.

- BOG – decision to implement. The licensees make an investment decision which results in submission of a PDO and/or PIO to the authorities.

After securing an approved PDO/PIO, the projects will continue to be reported as separate projects until they come on stream. After that, they become part of the normal reporting from the field.

Emissions to air

In this chapter:

The greenhouse gas emissions from the petroleum sector amounted to 10.9 million tonnes of CO2 equivalent (see fact box about different kinds of emissions) in 2024. This includes emissions from fixed and mobile facilities on the Norwegian continental shelf (NCS) and onshore process plants, meaning Kårstø, Kollsnes, Nyhamna, Melkøya, the Sture terminal and the oil terminal at Mongstad.

Of this, CO2 emissions amounted to 10.6 million tonnes. Methane emissions accounted for 10,871 tonnes or 0.3 million tonnes of CO2 equivalent. Emissions from the petroleum sector account for about one-quarter of Norway's overall greenhouse gas emissions. The sector is also a substantial source of NOX and NMVOC emissions.

Different kinds of emissions from the petroleum sector

Emissions to air from petroleum activities consist of more than the greenhouse gas CO2.

A brief overview of emission components other than CO2 follows below, as well as an explanation of the term CO2 equivalent:

Nitrogen oxides (NOx): A collective term for the nitrogen oxides NO and NO2, which are gases that have an acidifying impact on the environment.

Sulphur oxides (SOx): A collective term for sulphur dioxide (SO2), and sulphur trioxide (SO3).

Methane (CH4): In a 100-year perspective, methane (CH4) has a climate impact roughly 28 times as significant as the climate impact of CO2.

NMVOC (non-methane volatile organic compounds): A designation for volatile organic compounds with the exception of methane.

Black carbon: Black carbon refers to small particles that are formed in connection with incomplete combustion of fossil fuel and have a powerful warming effect.

CO2 equivalent: The overall warming effect from CO2 and methane is summarised as CO2 equivalent in the Norwegian Offshore Directorate's emission forecasts.

Methane and NMVOC also have an indirect impact in that they oxidise to CO2 over time and have an additional impact equivalent to pure CO2 emissions. This impact is included in the Norwegian Environment Agency's emission forecasts.

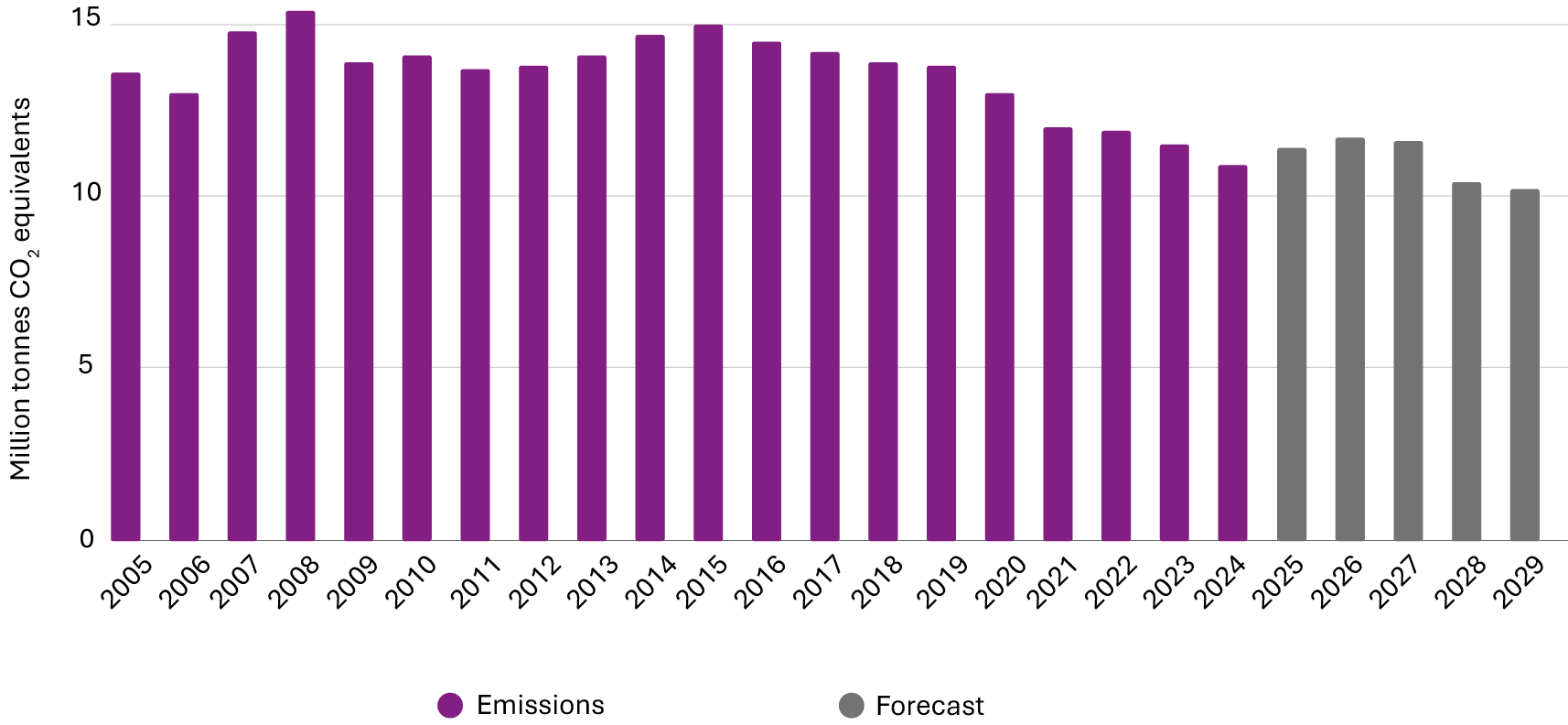

Figure 1 (below) shows annual emissions from 2005 to 2024, and a forecast up to 2029. The annual emissions of CO2 and CH4 have declined by 4.1 million tonnes of CO2 equivalent since 2015, despite production remaining relatively stable. This was primarily caused by multiple facilities being operated using power from shore in whole or in part. Emissions are expected to decline even further in the years ahead. This will take place despite a modest emissions increase over the short term.

Figure 1: Development in greenhouse gas emissions 2005-2024, and forecast up to 2029.

Emission sources

Energy generation on offshore facilities and onshore plants is the primary source of emissions to air in the petroleum sector.

A petroleum installation needs power for three primary use areas: generating electricity, operating equipment and generating heat. The power is generated by combusting gas in gas turbines.

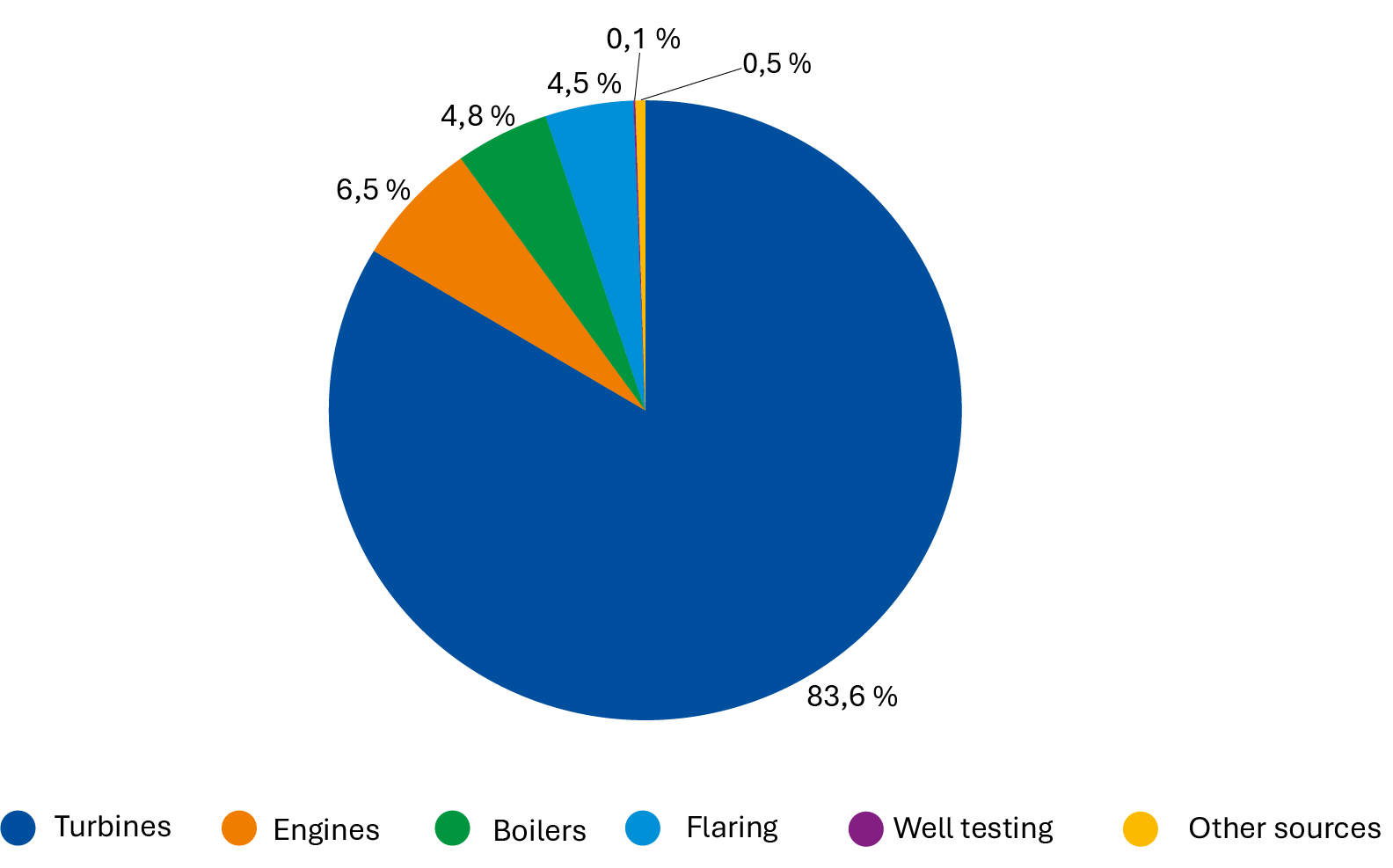

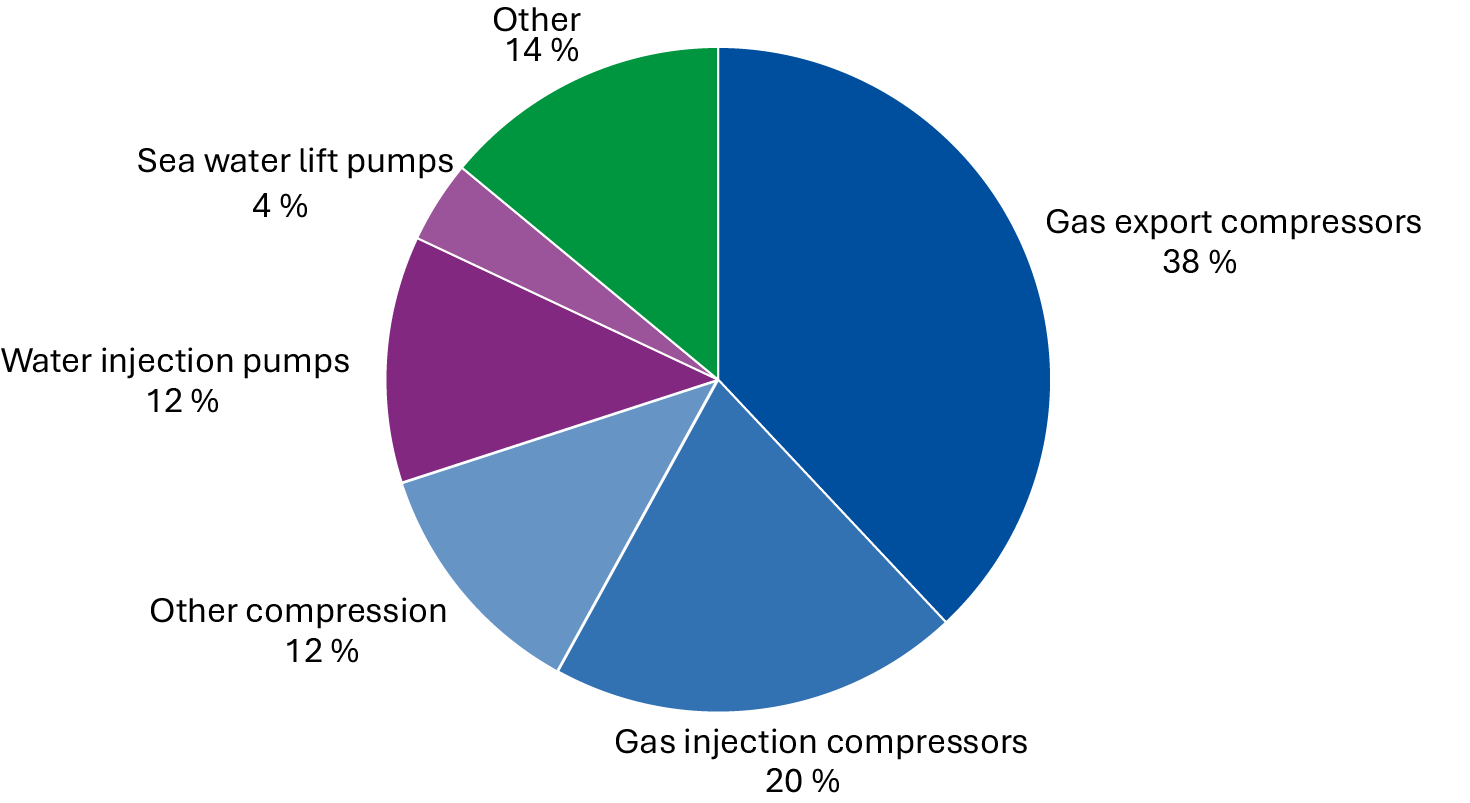

Gas turbines are the largest source of CO2 emissions from the NCS; see Figure 2. Diesel in motors is mainly used on mobile facilities, which means i.e. for drilling wells. In addition there are emissions from safety flaring of natural gas.

The largest sources of methane emissions is planned or unplanned direct emissions of natural gas to air, emissions associated with unburned natural gas in flares and turbines, and emissions in connection with storage and loading of crude oil.

Figure 2: Distribution of greenhouse gas emissions (CO2) by emission sources.

Measures to reduce emissions

Power from shore is the most important measure to reduce emissions from the petroleum sector. Replacing the power generated by gas turbines, in whole or in part, with power from shore, will reduce the emissions from the largest offshore emission source.

Work is also under way on other measures to reduce the emissions. Among these, the industry considers energy efficiency measures and reduced flaring to be the most important.

Energy efficiency measures

Energy efficiency measures include various measures that contribute to reduced energy needs and thereby reduced use of fuel gas in gas turbines. There are many options as regards energy efficiency measures, and these measures vary in scope, complexity, impact and costs. If energy consumption is reduced so that operations can be maintained with fewer gas turbines, this can result in relatively substantial energy savings.

Offshore wind

Other than power from shore, it is possible to reduce emissions using electricity from locally installed offshore wind turbines without a connection to the power grid. The emission reductions will not be quite as large as for power from shore, and the abatement cost will be higher. The facilities need a continuous supply of energy, so they will need to supplement with electricity from gas turbines when wind is not sufficient.

Gullfaks and Snorre are the only fields that receive electricity from offshore wind turbines, which comes from the Hywind Tampen wind farm. The development of Hywind Tampen took place with support from Enova and the NOx Fund. The wind farm is estimated to supply the fields with about 35 per cent of their annual need for electricity. Equivalent measures have been considered on Brage and Ekofisk, but they were rejected for financial reasons.

In time, installations can potentially be connected to offshore wind farms connected to the onshore power grid. Such wind farms can supply the facilities with electricity for large parts of the year, compared with electricity from local offshore wind with only a handful of turbines. Nevertheless, power from shore or continued use of gas turbines will be necessary periodically when there is insufficient wind power.

As of today, there are no such offshore wind farms operating on the shelf. The licensees on Ekofisk have considered connecting to the wind farm currently being planned in Sørlige Nordsjø II, but they chose to suspend the studies in 2025 due to excessive costs.

Carbon capture and storage

Equipment to capture and store CO2 from turbine exhaust (CCS) is challenging to install on existing facilities. Such equipment normally requires more space and weight capacity than what is available on the facilities. In other words, this technology is more relevant when developing new facilities. The licensees consider developing dedicated gas-fired power plants with CCS to supply existing facilities with electricity to be significantly more expensive than obtaining electricity from the onshore grid. This is why they have chosen not to proceed with this alternative.

Alternative fuels

Use of alternative fuels such as biofuels, hydrogen or ammonia, may be possible over the longer term. Access to and the price of fuel pose challenges. There is uncertainty associated with combustion in existing turbines and the modifications needed. Improvements in technological solutions and reduced costs will be necessary before such measures can potentially be adopted. Introducing alternative fuels could entail other types of risks, which will need to be handled.

Policy instruments to reduce emissions

The most important policy instruments to achieve reductions in greenhouse gas emissions from the petroleum sector are financial : taxes and participation in the EU Emissions Trading System (ETS).

The companies also need a permit pursuant to the Pollution Control Act and a flaring permit pursuant to the Petroleum Act.

Since they are subject to emission allowances in the EU's ETS system and taxes, the companies need to either reduce their emissions or pay for them. The emission costs have increased over time. In 2020, the level was about 860 2025-NOK/tonne, and today it is about 1860 NOK/tonne.

The Storting has adopted a gradual escalation of the CO2 tax, so the overall emission cost in 2030 shall amount to 2000 2020-NOK per tonne (equivalent to about 2400 2025-NOK). This also means a substantial increase in the CO2 cost moving forward, which the companies account for in their financial assumptions. The tax is adopted on an annual basis in connection with the Fiscal Budget.

See Report No. 1 to the Storting (2024-2025) and the bill and resolution Proposition 1 LS Supplement 1 (2021-2022) (Norwegian only).

Emission allowance requirement and CO2 tax

Emission allowance requirement

In 2024, 95 per cent of emissions in the petroleum sector were covered by the EU's Emissions Trading System. This entails an obligation to purchase allowances to emit CO2. The emission allowance price is determined in the emission allowance market. In 2024, the CO2 price in the EU's Emissions Trading System averaged EUR 66.60 or about NOK 775 per tonne of CO2. In early October 2025, it was about 78 EUR/tonne, or about 920 NOK/tonne (exchange rate of 11.8).

CO2 tax

In 2024, close to 86 per cent of emissions in the petroleum sector were subject to tax. The Act relating to tax on discharge of CO2 in the petroleum activities on the shelf stipulates that the companies must pay a CO2 tax for combusting gas, oil and diesel on the shelf, including the Melkøya onshore plant. There is also a tax for direct natural gas emissions, as well as for CO2 separated from petroleum and emitted to air. The CO2 tax for 2025 for combusting gas is 2.21 NOK/Sm3. Converted to NOK per tonne of emissions thus constitutes NOK 944.

Learn more about emission allowance requirement and CO2 tax.

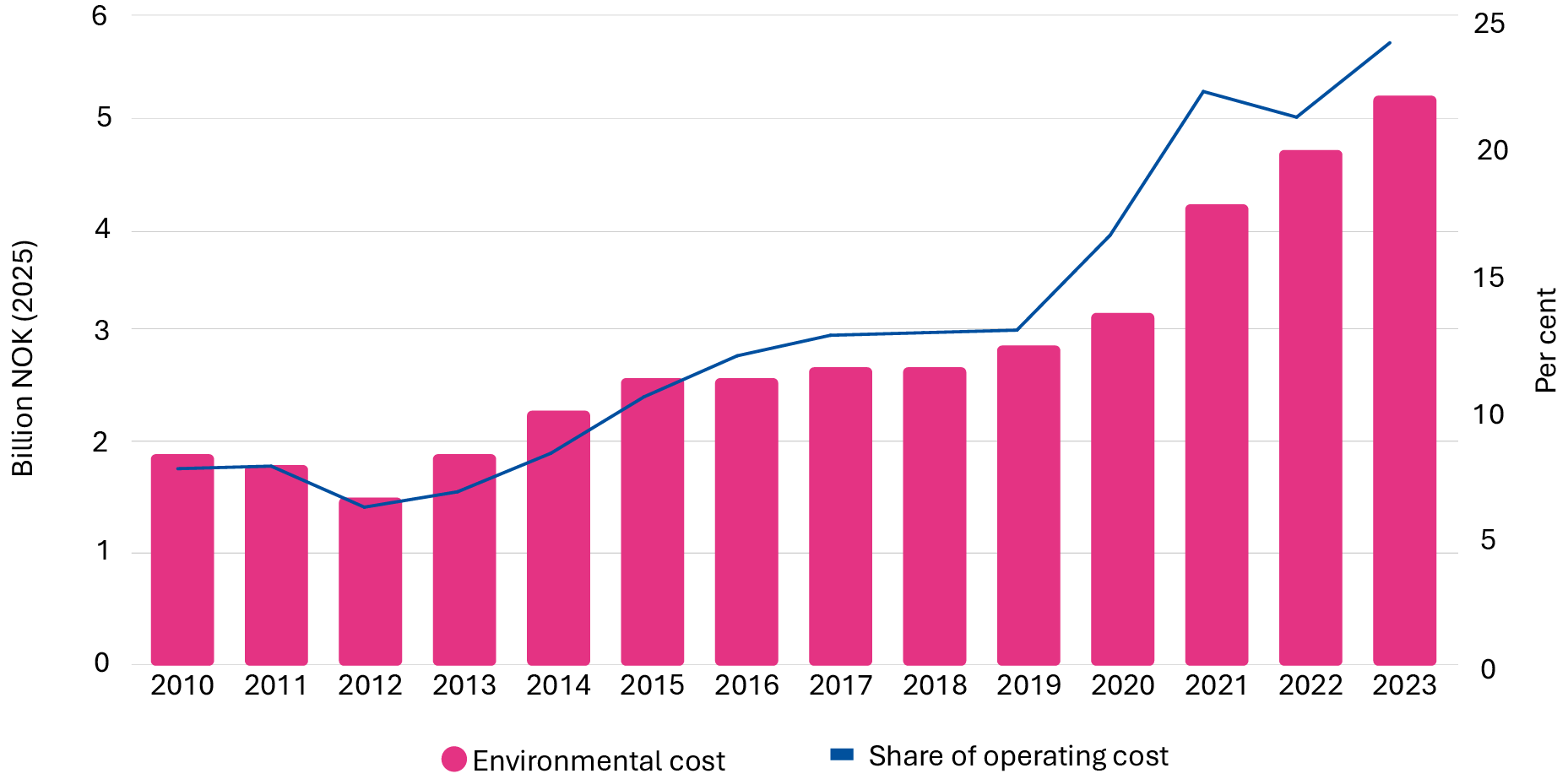

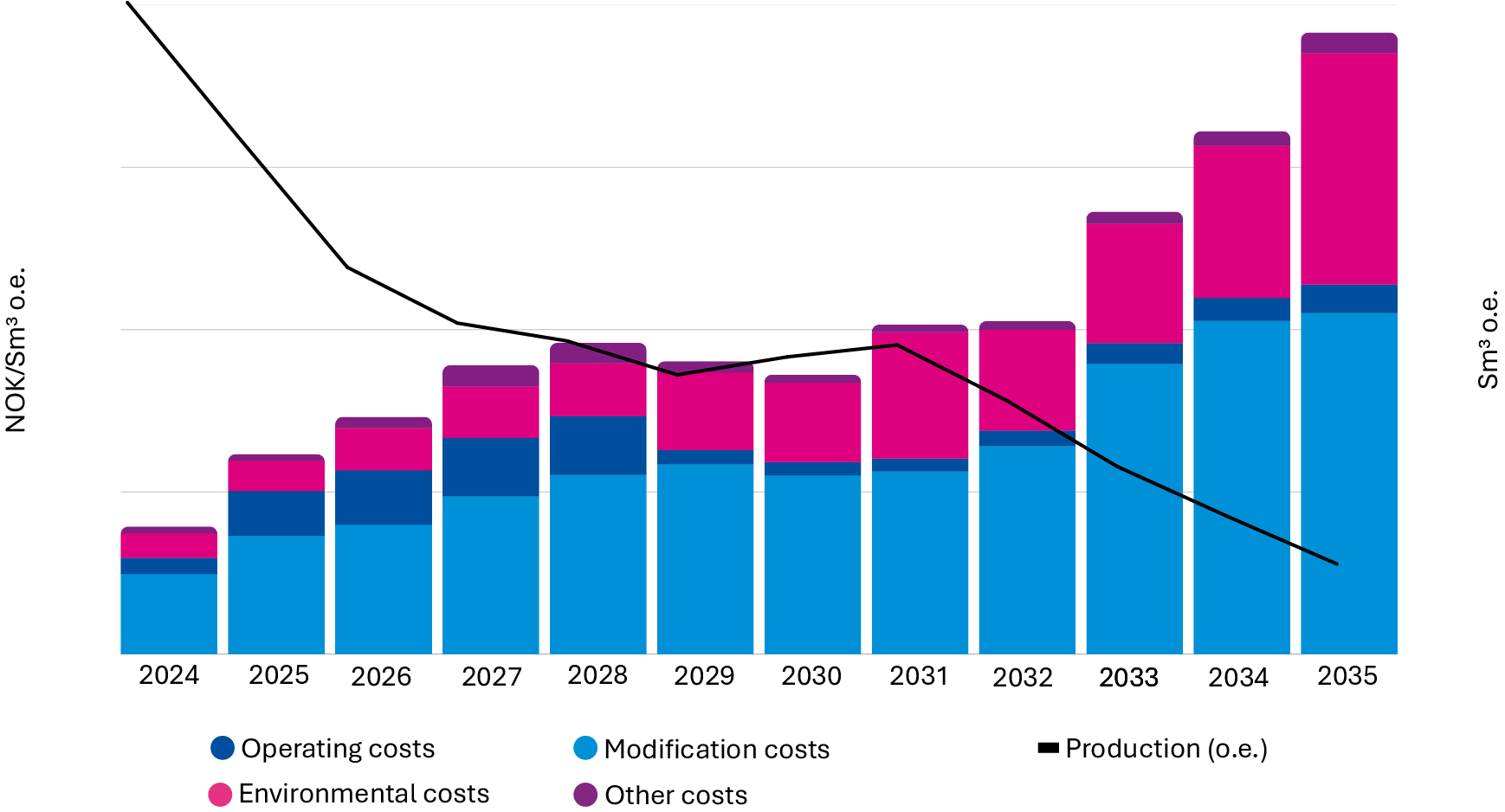

The increase in emission cost per tonne has led to a rising environmental cost on the fields over time. Higher environmental costs make up a substantial share of current costs for fields where energy generation takes place using gas turbines. Figure 3 (below) shows the development in environmental costs from 2010 to 2023 for fields where all energy consumption has been covered by gas turbines. For these fields, the environmental costs in 2023 accounted for nearly 24 per cent of operating expenses.

Figure 3: Development in environmental cost and share of environmental costs in per cent of operating costs for fields where all energy consumption is covered by gas turbines. The environmental cost here is the overall cost of CO2 emissions (tax and emission allowance requirement) and NOx tax. The latter constitutes about 3 per cent.

Major investments mean that a project to transition the energy supply to power from shore will require an extensive operating period in order to be profitable. According to current plans, the project now in the planning phase could be operational in 2032; see Chapter 5.

The companies' expected emission cost after 2030 is included in project profitability assessments. There is substantial uncertainty associated with developments in emission costs in the far future, and the companies will have different assessments regarding the size of this.

Profitability of power from shore projects

The profitability of a power from shore project is affected by a number of technical and economic factors. The most important economic elements will be discussed in the following.

Transitioning energy generation on a field from using gas turbines to power from shore may entail considerable investments. The investments can vary from facility to facility, depending on the cost of connecting to the onshore grid, the distance and the amount of electricity to be transmitted offshore and the extent of refitting and equipment to be installed on the facility. Read more in Chapter 3 of the 2020 Power from shore report.

Another significant cost is linked to purchasing electricity. This includes the grid tariff.

The gas, which is used as energy for the turbines, can be sold in the gas market given that there is available capacity to export the gas. This can generate substantial revenues.

Power from shore leads to reduced costs associated with greenhouse gas emissions: both the CO2 tax and costs linked to purchasing emission allowances. The size of future emission costs per tonne is a key assumption. In addition, there are costs saved in connection with gas turbine maintenance, minus costs associated with maintaining new power infrastructure.

If production on a facility needs to be shut down in connection with the refit, this leads to deferred revenue, which must be taken into consideration in the profitability calculations.

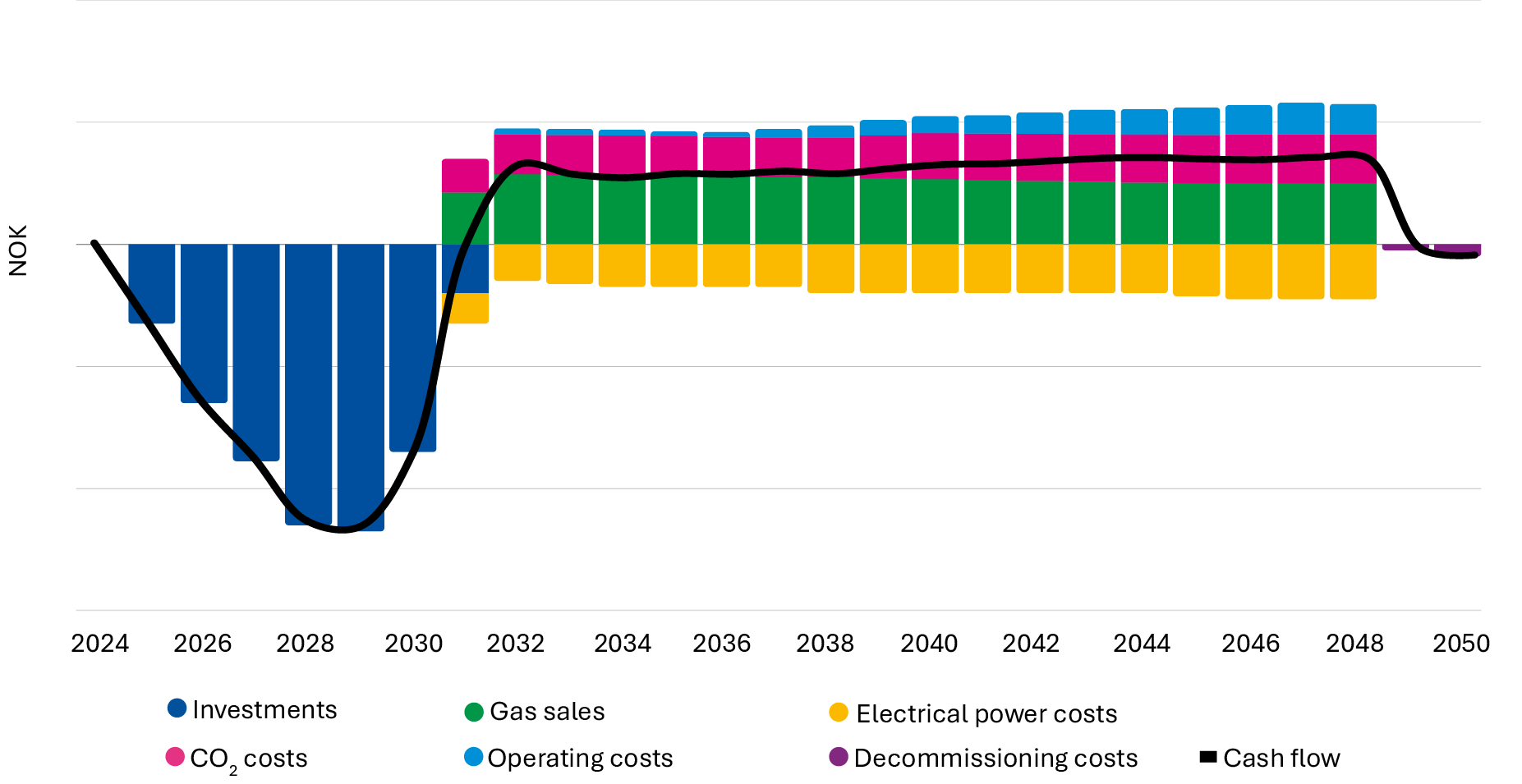

Figure 4: Outline – cash flow from a power from shore project.

The size of the overall cash flow for a power from shore project will also depend on the length of the operations phase with power from shore: The longer the operations phase, the higher the total cash flow.

In order to assess the profitability of such a project, the total net present value will be a key assessment criterion. This is in addition to the abatement cost; see separate fact box.

In addition to profitability estimates, the assessment of risk will be crucial in connection with a development decision. Changes in the size of the investments will typically have the greatest impact on the net present value. Experience has also shown that investments associated with refitting the facilities are the most difficult to estimate.

There are also other effects of power from shore that should be included in a comprehensive assessment. The 2020 report addresses a study by the Norwegian Ocean Industry Authority which shows that, overall, transitioning to operations with power from shore is positive for health, safety and the environment (HSE). There is also experience demonstrating that operational regularity is usually higher on fields with power from shore.

Power from shore projects will normally be extensive, and only profitable if there is a long expected lifetime. The companies' strategic assessments and assumptions regarding future changes to the framework conditions will also be important in connection with a development decision.

Measure cost

The Norwegian Offshore Directorate defines the abatement cost as the CO2 cost per tonne that yields a present value of zero with a 7 per cent discount rate. With this definition, the abatement cost indicates the minimum CO2 cost per tonne that is needed for the project to be profitable. If the expected future CO2 cost per tonne exceeds the abatement cost, a CO2 reduction project will be profitable. This calculation discounts both the cash flow and the reduction in CO2 emissions (which reflects revenue in the form of reduced CO2 costs).

There is also a different way to calculate the abatement cost. See Appendices C and D to the 2020 report for details about both methods.

Fields with power to shore

In 2020, facilities on the Troll, Gjøa, Ormen Lange, Valhall, Goliat and Johan Sverdrup fields were supplied with power from shore in whole or in part. Several fields were also tied back to these facilities, and they were therefore also receiving power from shore. Power from shore was under development on the Martin Linge, Edvard Grieg, Ivar Aasen and Gina Krog fields. This means that there was a total of 16 fields either running on power from shore or where power from shore was under development. All of them are now in operation.

Following the 2020 report, full or partial transition to power from shore was decided for the Troll B and C, Oseberg Field Centre and Oseberg Sør, Sleipner, Njord and Draugen facilities, as well as at the Hammerfest LNG onshore facility (Melkøya). Decisions have also been made to develop the fields in the Yggdrasil area with power from shore.

Tables 2, 3 and 4 provide an overview of fields with power from shore that are currently in operation, and fields where power from shore is under development. The tables also show associated fields where processing takes place on the host facility, and which are then operated using power from shore via this facility. When all projects under development are operational, there will be a total of 39 fields with power from shore.

Table 1 (below): Fields and facilities in operation with power from shore. Here, associated fields means subsea developments or simpler facilities such as wellhead platforms tied back to a host facility for processing and power supply. For these fields, the power solution is a result of choices made on the facility.

|

Field / facility |

Description |

Associated fields |

|

Troll A |

Troll A was the first facility to receive power from shore. Since the facility first came on stream in 1996, all of its power needs have been covered with electricity from Kollsnes. The volume of transmitted electricity has increased in multiple phases to compensate for falling reservoir pressure. |

|

|

Gjøa |

Parts of Gjøa's power needs are covered with power from shore. The gas export is run by a local gas turbine. With the aid of a heat recovery unit, this turbine also supplies necessary process heat. The field has been partially electrified since its start-up in 2010. |

The Vega, Nova and Duva fields are subsea fields operated with power from Gjøa. |

|

Ormen Lange/Nyhamna |

Ormen Lange is a subsea development with a pipeline to an onshore process plant (Nyhamna). The entire power need for the onshore plant and subsea facilities is supplied from the onshore grid. Ormen Lange came on stream in 2007. |

|

|

Valhall |

As part of a larger redevelopment on the field, a power from shore solution became operational in 2012. This is the first field to be refit from operation with gas turbines to operation with power from shore. The entire power need is covered from shore. |

The Hod field consists of a wellhead platform supplied with electricity from Valhall. The Fenris field is under development with an equivalent solution. |

|

Goliat |

Since its start-up in 2016, Goliat's entire power need has been covered with power from shore. Electric boilers cover the need for process heat. The facility also has a gas turbine with a heat recovery unit that has the capacity to cover the entire power need if this should be necessary. |

|

|

Johan Sverdrup |

This field was developed in two phases. When the first phase started up in 2019, power from shore was already in place. In connection with approving the development plan for phase 2, a decision was made to establish an area solution for power from shore. The area solution would cover the Edvard Grieg, Ivar Aasen and Gina Krog fields. It was also designed for possible increased needs on the associated fields, as well as any future third-party tie-backs. Johan Sverdrup phase 2 started up in late 2022. The entire power need is covered with power from shore. |

|

|

Martin Linge |

This field was developed with power transmitted via a cable from Kollsnes. The field was connected to power from shore in November 2018 and started producing oil and gas in 2021. The entire power need is covered with power from shore. |

|

|

Edvard Grieg |

This field, which came on stream in 2015, has been running on power transmitted via Johan Sverdrup and the area solution on the Utsira High since 2022. The entire power need is covered with power from shore. |

Solveig is a subsea field with power supplied via Edvard Grieg. |

| Gina Krog | This field, which came on stream in 2018, has been running on power transmitted via Johan Sverdrup and the area solution on the Utsira High since 2023. The entire power need is covered with power from shore. | Eirin is a subsea field under development which will receive power via Gina Krog. |

| Ivar Aasen | Since the field came on stream, Ivar Aasen's entire power need has been covered via a power cable from Edvard Grieg. Since the area solution on the Utsira High became operational in 2022, Ivar Aasen has also been running on power from shore. | Hanz and Symra are two subsea fields tied back to Ivar Aasen. Symra is under development. |

| Sleipner |

The development plan for transitioning Sleipner to partial operation with power from shore was approved in 2021. A decision was made to connect Sleipner to the area solution on the Utsira High with a power cable via Gina Krog to Sleipner A. The premise was that Sleipner would receive any available power once other fields' consumption was covered, while some power would still be generated by gas turbines. Since the power transmission solution became operational in 2024, Sleipner has received more electricity than what was originally presumed. The licensees are considering whether to use additional available electricity from the Utsira High to electrify additional equipment. |

The other fields tied back to Sleipner are Sigyn and Utgard, which are subsea fields, and Gungne, which was drilled with three wells from the Sleipner A facility. |

| Gudrun | Since Gudrun started up in 2014, it has been running on power transmitted via a cable from Sleipner A. Since power transmission from the Utsira High to Sleipner became operational in 2024, Gudrun has also been operated with power from shore. |

Table 2 (below): Fields and facilities where the transition to power from shore is under development. Here, associated fields means subsea developments or simpler facilities such as wellhead platforms tied back to a host facility for processing and power supply. For these fields, the power solution is a result of choices made on the host facility.

|

Field / facility |

Description |

Associated fields |

|

Troll B and C |

The development plan for transitioning to power from shore for Troll B and C was approved in 2021. The decision involved partially electrifying Troll B and fully electrifying Troll C. Partial electrification of B and C became operational in 2024, and work is under way on full electrification of C. The power station at Kollsnes and the subsea cable were built with the capacity to potentially fully electrify Troll B at a later date. The licensees decided to cancel work on this project in 2024. |

The Fram, Fram H-Nord and Byrding fields are all subsea fields supplied with power from Troll C. |

|

Oseberg and Oseberg Sør |

A refit of the Oseberg Field Centre and Oseberg Sør to partial operation with power from shore was approved in 2022. This project is under development. The power station at Kollsnes and the subsea cable are prepared for additional electrification. In the summer of 2024, the licensees decided to suspend work on additional electrification of the Oseberg Field Centre. |

Tune is a subsea field that receives power from the Oseberg Field Centre. |

|

Draugen |

Njord's refit to power from shore is a coordinated development with Draugen, approved in 2023, where a cable is laid from shore to Draugen and further on to Njord. Draugen will be fully electrified after the refit. When major motor loads are started up, such as gas compressors and loading pumps, a gas turbine is started up to provide the necessary extra power to start the motors. |

|

|

Njord |

Njord's refit to power from shore is a coordinated development with Draugen, approved in 2023, where a cable is laid from shore to Draugen and further on to Njord. Njord will be partially electrified. The gas turbines, which are currently used to generate power for Njord A and B, will be replaced with power from shore. As before, gas export will be operated by a gas turbine. |

Bauge, Fenja and Hyme are subsea fields that receive power from Njord. |

|

Snøhvit/Melkøya |

Snøhvit is a subsea facility with a pipeline to the onshore facility on Melkøya, Hammerfest LNG. The onshore facility has primarily been operated with power generated by gas turbines and a heat recovery unit that covers the LNG plant's heating needs. The transition to full operation with power from the grid was approved in 2023. This project is under development. After the refit, the heating need will be covered by electric steam boilers. The total transmission capacity after the refit is considered to be sufficient to cover any future needs on Snøhvit, for example offshore compression. |

|

Table 3 (below): New field developments with power from shore.

|

Area |

Description |

|

Yggdrasil |

Yggdrasil is the name of a coordinated development of the Hugin, Munin and Fulla fields in the central part of the North Sea. The area consists of multiple discoveries and a previously shut down field, and is under development. The area is being developed with power from shore to the Hugin A facility and further on via cable to Munin. The other facilities, consisting of a wellhead platform (Hugin B) and seabed templates, will have their power need covered from Hugin A and Munin. The total transmission capacity is considered to be sufficient to cover future power needs in the area. |

Undergoing planning

In this chapter:

- Major modifications in connection with transitioning to power from shore

- Challenging to achieve profitability

- Several projects have been discarded

As of October 2025, there is only one project where a transition to power from shore is planned, namely the area solution on Balder and Grane. This project includes transitioning to partial operations with power from shore, combined with accelerated gas production for the Grane field.

The decision to concretise this project was made in the first half of 2024. Since then, the licensees have been working on more detailed studies to clarify the best concept. The concept selection is scheduled for late autumn 2025 and a potential investment decision in late 2026.

According to the mandate, the report shall cover any new power from shore projects reported in autumn 2024 where a decision to concretise has yet to be made. There are no such new projects.

There have been multiple projects in the planning phase in recent years. Studied projects have turned out to be more complex and yield lower profitability than previous power from shore projects. With the exception of the project on Balder/Grane, these projects have been discarded. In the rest of this chapter, we will examine developments in these projects in more detail.

Major modifications in connection with transitioning to power from shore

An existing facility must be modificated to install power from shore. Refitting existing facilities is usually much more expensive than setting up a new field with power from shore.

Among other things, the costs and work involved in refitting depend on how much equipment needs to be replaced on the facilities. The easiest method is to replace the gas turbines that supply electricity to the facilities. It is more complicated and more expensive to replace gas turbines that run direct-driven equipment like gas compressors. This is why many fields are only partially electrified. The distance to shore also has an impact on the cost level.

Transitions to power from shore on producing fields must take place while the plant is operational. The number of beds, space and weight capacity for equipment are often limited. If the work requires a temporary production shutdown or chartering a flotel to increase the number of beds, this increases the costs. For more details about power from shore technology, see Chapter 3 of the 2020 report.

Challenging to achieve profitability

The most profitable power from shore projects have already been approved. As the CO2 cost has increased, the companies have evaluated and approved multiple power from shore projects.

In the most recently approved projects (Melkøya and Njord/Draugen), the operator's estimated abatement cost was just under NOK 2000 per tonne of CO2 (2025-NOK). The Storting's decision to increase the CO2 cost leading up to 2030 contributed to the approval of these projects. Read more about the CO2 tax and the profitability of power from shore projects in Chapter 3 .

What the projects that have been in the planning phase in recent years have in common is that they have had a higher cost level than already approved projects.

Estimated abatement costs at the decision to concretise (BOK) are uncertain. As a project matures and passes the various project milestones of BOK, BOV and PDO, the estimates become more precise. More detailed studies and analyses provide a better basis for cost estimates. Experience indicates that cost estimates are more likely to increase from BOK to PDO than the opposite.

Several of the power from shore projects that have been studied have increased their cost estimates since BOK. This is due to a better understanding of the scope of work. Recent years have also seen a general cost increase that has further affected the cost estimates.

Several projects have been discarded

Several plans to transition to power from shore have been changed over the past few years. For technical and economic reasons, the licensees have stopped projects or reduced their scope.

In 2024, work was discarded on the effort to fully electrify Troll B and further electrification of the Oseberg Field Centre. The same year, the area solution on Tampen, which then consisted of the Visund, Snorre and Gullfaks fields, was scaled back in scope and power need. The electrification of Visund was cancelled.

There were also changes in projects reported in autumn 2024. In the first half of 2025, the licensees decided to cancel work on connecting Skarv to an area solution on the Halten Bank, which then consisted of the Skarv, Kristin, Åsgard and Heidrun fields. The project was no longer considered profitable. For the same reason, the licensees in the Greater Ekofisk Area stopped work on connecting to the wind farm planned by Ventyr in Sørlige Nordsjø II.

On Tampen, the licensees decided to discard the project that included partial electrification of Gullfaks. The project on Snorre was also scaled back. The schedules for the remaining projects on the Halten Bank, Tampen and Balder/Grane were also delayed.

In October 2025, Equinor sent a letter to the Ministry of Energy recommending stopping all work on electrification of the Halten Bank and Tampen. The stated reason was that the abatement cost had become too high.

In other words, of the projects reported to the Norwegian Offshore Directorate in connection with RNB reporting in autumn 2024, only one project is still in the planning phase, namely power from shore to Balder/Grane.

The Balder/Grane project includes transitioning to partial operations with power from shore, combined with accelerated gas production for the Grane field. This project will use shared infrastructure with a substation at Haugalandet/Gismarvik, a power cable to a new platform on the Grane field and power cables from there to Jotun and Ringhorne on the Balder field. The emissions can be reduced by about 380,000 tonnes of CO2 per year. A potential investment decision is planned for the end of 2026. Planned start-up is in 2032.

Resource consequences

For a number of fields, power from shore will most likely not be profitable. These fields have few opportunities to achieve major emission reductions. High CO2 costs could thus lead to negative consequences as regards resources.

In this chapter:

- Energy consumption on the facilities

- Consequences for improved recovery

- Phasing in third-party fields

- Fields may have shorter lifetimes

- Consequences for exploration activity

The expectation is that a number of fields will continue to operate using gas turbines; see Table 5. As shown in Figure 3, these fields will be subject to significant CO2 costs.

High costs provide an incentive to reduce greenhouse gas emissions. At the same time, the options for implementing substantial emission-reduction measures on these fields may be limited. Factors such as a short remaining lifetime, long distance to shore, and/or significant refitting needs will mean that power from shore is not profitable. For this reason, several projects to transition to power from shore have been scaled back or stopped; see Chapter 5 .

Even if transitions to power from shore are not implemented, high CO2 costs will provide an incentive for licensees to carry out operational adjustments. This could include anything from minor energy efficiency measures to earlier shutdown and/or consolidation of infrastructure. This chapter deals with potential resource-related consequences of high CO2 costs and emission reduction measures.

Table 5 (below): Fields without plans to transition to operation with power from shore. Several of these are host fields that process oil and gas, and they deliver electricity to connected fields (righthand column). *Gullfaks and Snorre receive partial electricity supplies from the Hywind Tampen wind farm.

|

Field |

Connected fields in operation and under development |

|

Alvheim |

Vilje, Volund, Bøyla, Skogul og Tyrving |

|

Brage |

Bestla |

|

Ekofisk |

Tommeliten A, Tor |

|

Eldfisk |

Embla |

|

Gullfaks* |

Gimle, Sindre, Gullfaks Sør, Tordis, Visund Sør |

|

Heidrun |

|

|

Johan Castberg |

|

|

Kristin |

Tyrihans, Maria |

|

Kvitebjørn |

Valemon |

|

Norne |

Urd, Skuld, Alve, Marulk, Verdande |

|

Skarv |

Ærfugl Nord, Alve Nord, Idun Nord, Ørn |

|

Snorre* |

Vigdis |

|

Statfjord |

Statfjord Nord, Statfjord Øst, Sygna |

|

Ula |

Oda, Tambar, Tambar Øst, Blane |

|

Visund |

|

|

Yme |

|

|

Aasta Hansteen |

Irpa |

|

Åsgard |

Mikkel, Morvin, Trestakk, Berling, Halten Øst |

Energy consumption on the facilities

Petroleum facilities need energy for several purposes including operation of the process plant, exporting oil and gas, drilling wells, heating and lighting.

Much of this energy goes to the operation of large compressors and pumps. Gas compression is used to increase the pressure of gas for export, increased production of oil through reinjection in the reservoir or for gas lift. Pumps are also used for oil export and for water injection for improved oil recovery. Figure 5 illustrates the distribution of energy to various purposes.

High emission costs tend to promote lower energy consumption. This could result in resource consequences if energy-intensive measures are not approved.

Figure 5: Energy consumption distributed by activities (Source: Equinor,18 facilities on the NCS, 2022).

Consequences for improved recovery

For a field with energy generation based on gas turbines, environmental costs could impact the selection of recovery strategy, both for producing fields and in future projects. This is because a number of the measures that helps maintain production on the fields require energy. High CO2 costs thus contribute to reduce the profitability associated with such production measures.

One example of this is pressure support. Injection of gas or water is used in most oil reservoirs to improve recovery. A new project can require substantial investments, such as for drilling wells for this purpose. Costs in the operations phase are largely linked to energy consumption. Reduced injection of water in the reservoir on a field will reduce energy consumption, but it can also entail reduced production over the short or longer term.

Low-pressure production is another example. Declining reservoir pressure reduces the production of oil and gas over time. Production can be maintained and a higher recovery rate secured by lowering wellhead pressure or separator pressure on the facility. This is becoming increasing relevant as the fields on the Norwegian shelf grow older. Low-pressure production requires more energy because the gas that goes to injection or export must be compressed from a lower pressure.

It is difficult to estimate just how much higher CO2 costs will reduce recovery measures. Investment costs and the volume of recoverable resources will normally have greater significance for profitability as compared with costs associated with operation.

Phasing in third-party fields

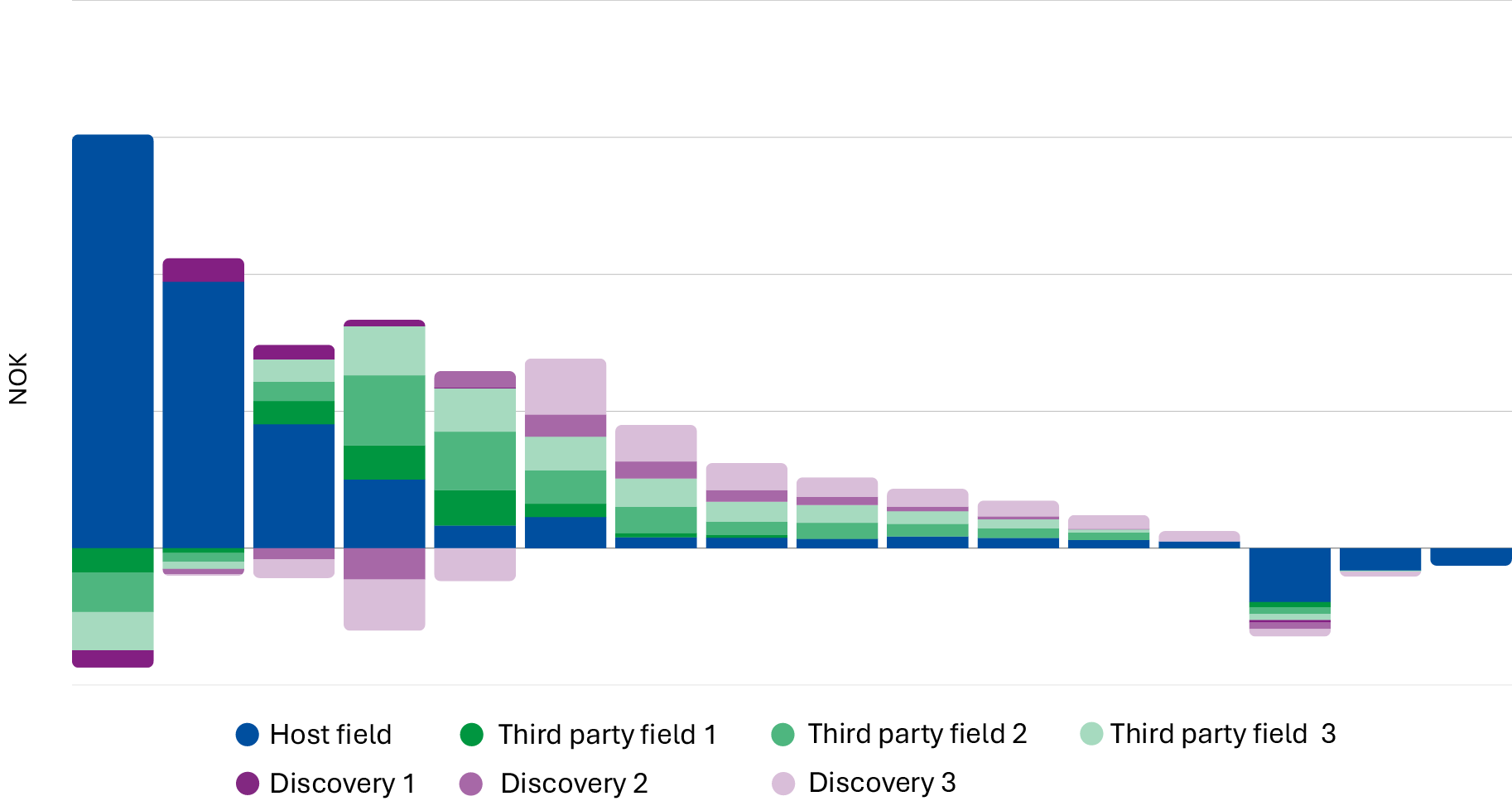

Many fields on the Norwegian shelf function as hosts for third-party fields. This means that smaller discoveries in nearby areas can be connected to existing infrastructure on the host field. This contributes to extended production and lifetime for the host field. This is important in order to maximise resource utilisation and value creation, both in the area and on the NCS as a whole. The existing discovery portfolio largely consists of discoveries with expected development using subsea solutions.

The phase-in of third-party volumes can lead to an increase in overall energy consumption on the host field, either as a consequence of increased power consumption for production of oil and gas from third-party fields, or that the production is extended over time. High CO2 costs help make fields without power from shore less attractive host fields.

Conversely, fields with power from shore projects undergoing planning or development can entail higher costs for licensees that consider tying in discoveries, if they have to help cover the costs. Tying in discoveries could also be deferred because of insufficient capacity to carry out modification work offshore alongside the conversion to power from shore.

The most important factor for phasing in third-party fields appears to be that the companies are also considering the possibility that low emissions on the field/facilities may be a precondition for continued operation over time. Fields that do not have low emissions could thus become less relevant as host facilities for new subsea fields.

One consequence of this could be the selection of more expensive electrified tie-in alternatives. This could also lead to a backlog of projects to the same host facility, such that fields are commissioned later, fields without power from shore are shut down earlier and/or exploration in the nearby area declines.

Figure 6 below illustrates cash flow for all resources linked to a host facility. The overall value grows when multiple fields share the cost of using existing host facilities.

Figure 6: Estimated future cash flow for host fields and third-party fields (sample fields). With third-party fields and discoveries tied into host fields, the shutdown date in this example is 2037. When multiple fields share the cost of using existing host facilities, this increases overall value and contributes to extending lifetimes.

Fields may have shorter lifetimes

Under normal circumstances, a field has just a few years at plateau production, followed by a relatively long period of tail production . Operating costs can be relatively stable. This results in gradually increasing costs per produced unit, and a decline in cash flow; see Figure 7. Increasing environmental costs lead to a further reduction in positive cash flow, and can contribute to accelerating shutdown.

To offset this effect, licensees will consider reducing energy consumption and the number of turbines in normal operation. The extent to which energy consumption can be reduced, and how this might potentially affect recovery over the shorter and longer terms, will vary. Projections indicate that a relatively large increase in CO2 cost would have to occur in order to entail any substantial curtailment of the production period.

One alternative to a complete shutdown of the activity on a field may be consolidation, in the form of shutting down parts of the infrastructure on the field.

Figure 7: Development in cost per produced unit (sample field).

Consequences for exploration activity

The vast majority of future developments of new discoveries are expected to consist of subsea solutions tied into nearby infrastructure.

If existing fields and infrastructure are shut down, or if capacity is reduced due to consolidation, the development of these discoveries will become more expensive and more complex. This will particularly be the case where there is no alternative infrastructure nearby. This could lead to lower exploration activity because it undermines profitability.