1 – Resource Accounts

Shortcut:

- 1.1 Petroleum resources on the Norwegian continental shelf

- 1.2 Petroleum resources in Norwegian sea areas

Primary trends:

- Reduction in the volume of overall petroleum resources

- Reduction in the volume of undiscovered resources, mostly in unopened areas

- Minor increase in the volume of reserves and contingent resources

1.1 Petroleum resources on the Norwegian continental shelf

Petroleum resources are discovered, and discoveries are developed as fields if they are economically and technologically viable, and the oil and gas is produced and sold. This results in dynamic resource accounts that change from year to year.

This report is an appendix to the Resource Accounts as per 31 December 2023 (Excel) for the Norwegian shelf in 2023. The report describes changes from last year's Resource Accounts with the aid of simple analyses, figures and tables.

According to the Resource Accounts as per 31 December 2023, the estimates for the overall resource volumes (including what has been sold and delivered) on the Norwegian shelf are:

- 8,193 million standard cubic metres (Sm³) of oil

- 6,566 billion Sm³ of gas

- A total of 15,575 million Sm³ of oil equivalent (o.e.)

- This is a reduction of 191 million Sm³ of o.e. compared with the previous year.

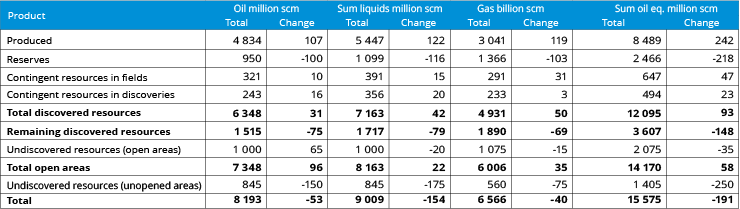

The total estimates for oil, liquids (sum of oil, condensate and natural gas liquids/NGL) and gas are shown in Table 1-1 along with changes from the Resource Accounts in 2022.

The petroleum resources are divided into resource categories, reserves, contingent resources and undiscovered resources. The categories are described in the report's appendices.

Discovered resources have increased by 93 million Sm³ of o.e., compared with the Accounts from 2022. This is due to increases in reserves and contingent resources in fields and discoveries. Remaining discovered resources have been reduced by 148 million Sm3 of o.e. The petroleum production in 2023 is 237 million Sm³ of o.e. The change in the Resource Account is 242 million Sm3 of o.e. The discrepancy is accounting technical and is due to the difference between the reported historical production and the database for production. Undiscovered resources have been reduced by 285 million Sm³ of o.e, primarily in unopened areas.

In the table below, opened areas are defined as areas opened for petroleum activity. The volumes are listed in oil equivalent, o.e. (1,000 Sm³ of gas = 1 Sm³ of o.e.).

Table 1-1 Expected values for petroleum resources as per 31 December 2023 with changes from 2022. (Liquids are oil, condensate and NGL).

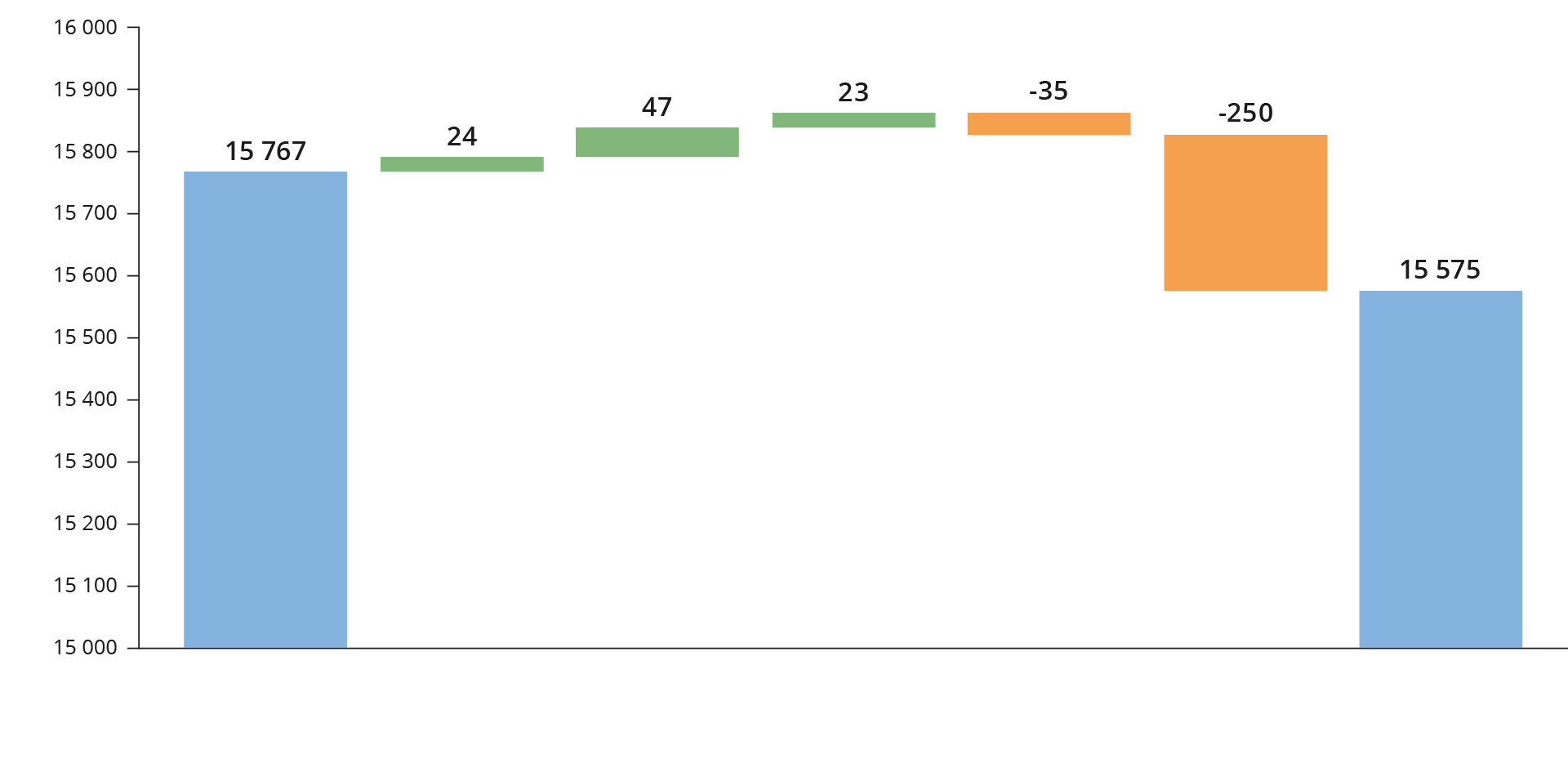

Figure 1-1 shows how the resource categories have changed over the previous year. The change in the volume of overall resources in 2023 is 1.2 per cent of the total petroleum resources of 15,575 million Sm³ of o.e. The Y axis in this plot starts at 15,000 million Sm³ o.e. in order to highlight the various changes.

Figure 1-1 Changes in resource volume for 2023, distributed across resource categories in the Resource Accounts.

The volumes of contingent resources (no decision to develop) in fields and discoveries have increased by 47 million Sm³ of o.e. and 23 million Sm³ of o.e., respectively. In a field context, the primary cause of this increase is resources in projects in the planning phase. Regarding to contingent resources in discoveries, the increase is caused by results from exploration activity.

The decline in the volume of undiscovered resources was primarily caused by a reduction in the estimate for the Barents Sea North, which is an ocean area that has not yet been opened for petroleum activity. The Norwegian Offshore Directorate estimates the volume of undiscovered resources both in acreage opened for petroleum activities, as well as in unopened acreage. These estimates contain the volumes of petroleum that we estimate could be extracted from deposits that have yet to be proven through drilling.

The overall petroleum resource volume has been reduced by 191 million Sm³ of o.e., or 1.2 per cent, since 2022. This is the largest reduction since 2010.

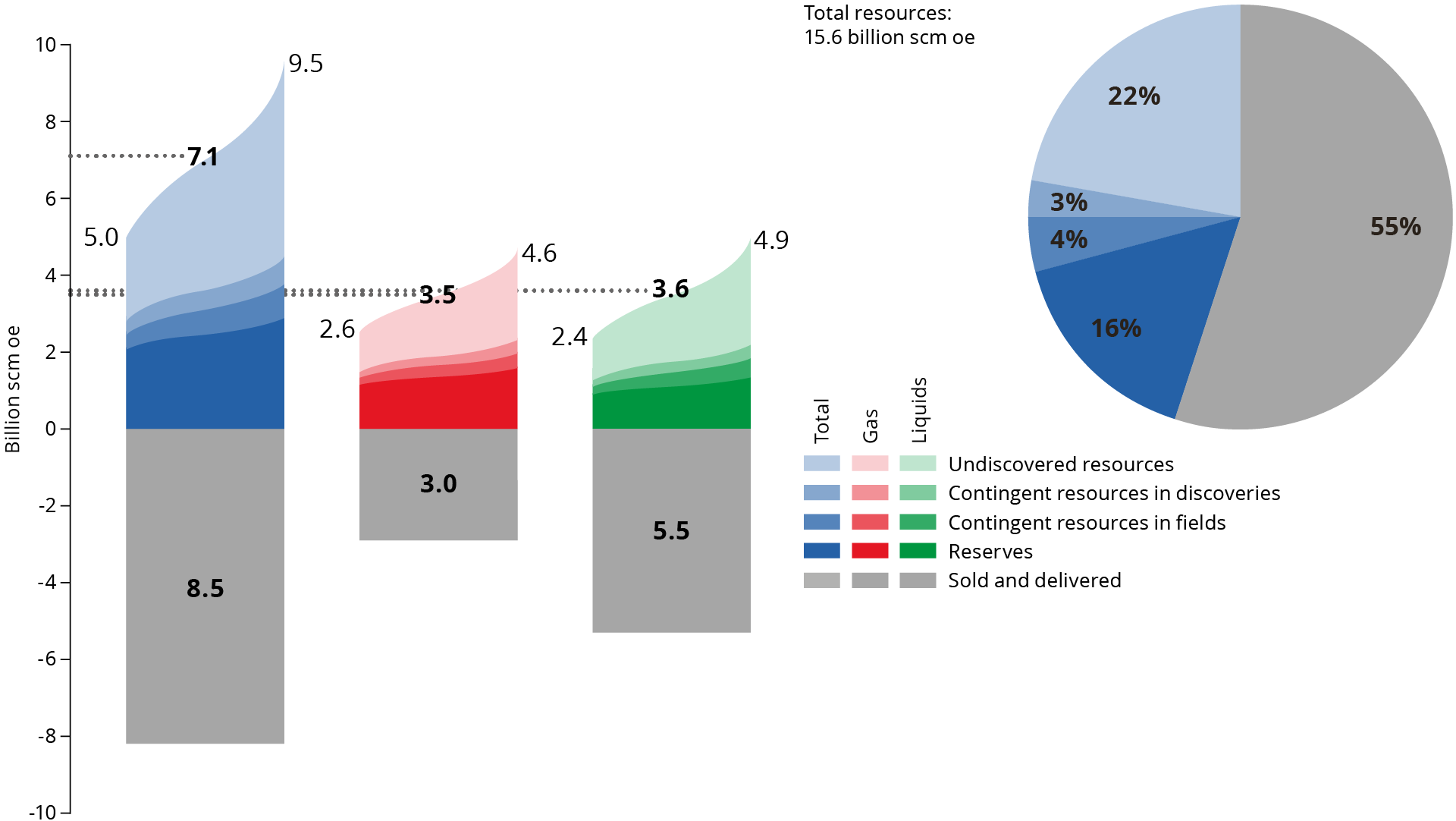

The distribution of and uncertainty in the remaining resource volumes, along with the volume sold and delivered as per 31 December 2023, is shown in Figure 1-2.

The middle of the columns shows the expected volume of recoverable petroleum. Uncertainty in the overall estimates is illustrated with a low estimate on the left and a high estimate on the right in each column, and this declines along with an increasing level of maturity for the resources. For example, this means that there are more uncertainties associated with contingent resources than reserves, such as geology, flow properties and use of technology.

The pie chart on the right side of the figure shows the distribution across the resource categories for the overall resources. The total volume has declined compared with 2022, and the distribution has changed as a result of last year's production and the reduction in the volume of undiscovered resources.

Figure 1-2 Petroleum resources and uncertainty in the estimates as per 31 Dec. 2023

1.1.1. Resource development

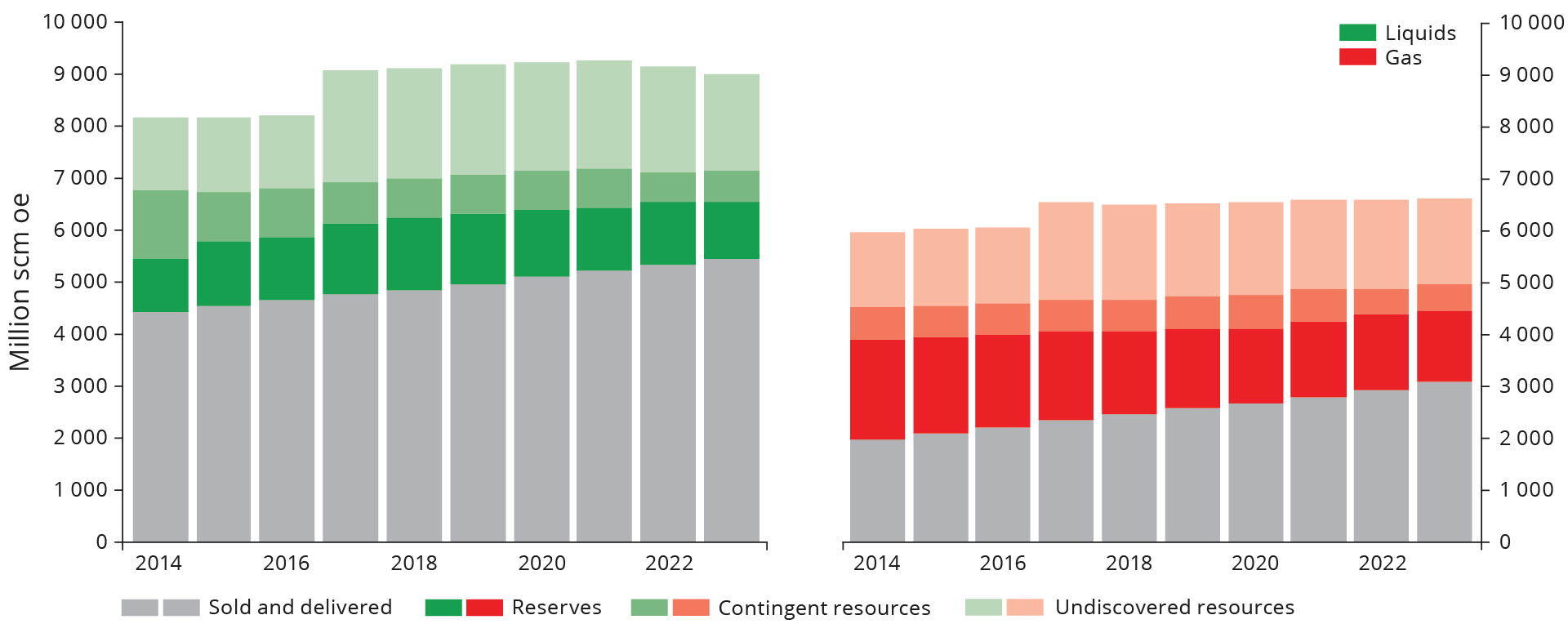

Resource estimates for petroleum will change over time. New information and knowledge change the expected value and uncertainty associated with the overall resources. As the resources are mapped, proven, matured and finally produced, their resource category will also change. Figure 1-3 below shows the changes in estimates per category for liquids and gas over the last ten years.

Figure 1-1-3 Development in expected value for volume of liquids and gas resources over the last ten years. Liquids on the left and gas on the right.

There has been a steady increase over time in discovered resources for liquids and gas, and this increase ended for liquids in 2022. Following a minor reduction last year, discovered resources have returned to a trend of continuous growth. 2023 yet again saw an increase in discovered liquids resources, while there is a reduction in the volume of undiscovered resources.

The increase in 2017 of the resource estimates for undiscovered resources was caused by the inclusion of the resources in the Barents Sea North.

1.2. Petroleum resources in Norwegian ocean areas

The three ocean areas – the North Sea, Norwegian Sea and Barents Sea – are different regards to geology, resource base, maturity and scope of infrastructure and knowledge. An overview of resources in the three ocean areas can be found in the Resource Accounts as per 31 December 2023 (Excel)

There has been petroleum activity in the North Sea since 1965. The Norwegian Sea and Barents Sea (areas north of the 62nd parallel) were opened for petroleum activities in 1980.

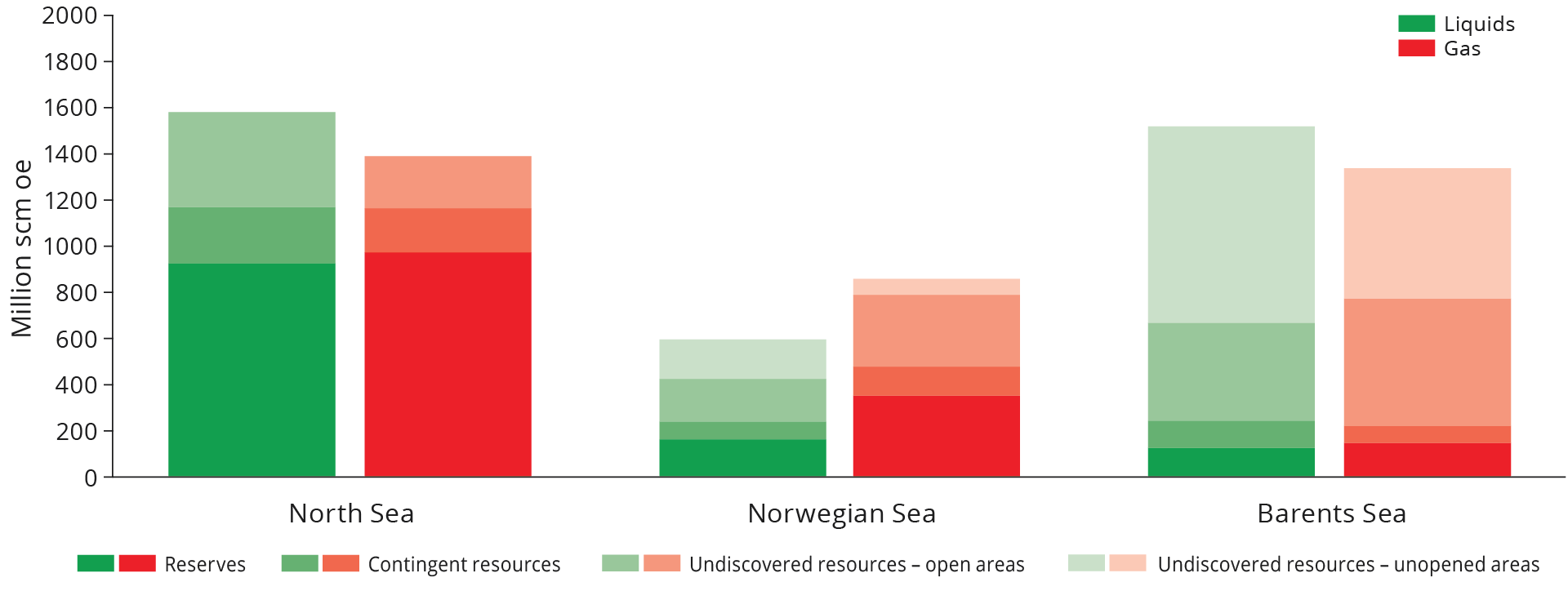

The remaining resources and distribution between discovered and undiscovered resources in opened and unopened areas, respectively, differ between the three ocean areas. The largest volume of undiscovered resources is in the Barents Sea, the last area to be opened. The expected estimates can be found in Figure 1-4, which shows the distribution for liquids and gas, respectively. The volume estimates do not reflect uncertainty, which declines with increasing maturity. For example, the actual future production of contingent resources will be more uncertain than reserves.

In the North Sea, which has been an active petroleum province the longest, and therefore has more history, experience and available information, the majority of the liquids and gas are defined as reserves, which means that they have approved plans for production. Of the remaining resources in the North Sea, 60 per cent are classified as reserves, of which 47 per cent is liquids and 54 per cent is gas.

In the Norwegian Sea, reserves account for 34 per cent of the remaining resources, which are distributed between 32 per cent liquids and 68 per cent gas. The undiscovered resources make up the largest share of the remaining resources with 52 per cent.

Vast areas in the Barents Sea have yet to be opened for petroleum activity, and this is where we find the greatest expected value for undiscovered resources. Most of this, 82 per cent of the remaining liquids and gas resources in the Barents Sea, has yet to be discovered.

Figure 1-4 Distribution of remaining volumes of liquids and gas resources (expected values) distributed by ocean area and resource category. Liquids resources are shown in green and gas resources in red.