The Shelf in 2018

10/01/2019 The Norwegian Petroleum Directorate’s forecasts show that, after a minor decline in 2019, oil and gas production will increase from 2020 and up to 2023. Overall production will then approach the record year of 2004.

“The activity level on the Norwegian Shelf is high. Production forecasts for the next few years are promising and lay a foundation for substantial revenues, both for the companies and the Norwegian society. There is considerable interest in exploring for oil and gas,” says NPD Director General Bente Nyland.

Exploration activity was considerably higher last year in than in the two previous years. The number of exploration wells has increased dramatically, and 87 new production licences were awarded, which is a new record.

A total of 53 exploration wells were spudded last year, compared with 36 in 2017. The companies’ plans show that this number will probably remain at the same high level in 2019. Eleven discoveries were made, with a preliminary resource estimate of 82 million standard cubic metres of recoverable oil equivalents (o.e.). This is higher than each of the three previous years.

“The high level of exploration activity proves that the Norwegian Shelf is attractive. That is good news! However, resource growth at this level is not sufficient to maintain a high level of production after 2025. Therefore, more profitable resources must be proven, and the clock is ticking,” says Nyland.

She notes that nearly two-thirds of the undiscovered resources are in the Barents Sea. This area will be important for maintaining high production over the longer term.

Norway is an important long-term supplier of gas to Europe. Gas can contribute to more sustainable development in three ways: by providing reasonable and stable access to energy, by displacing use of coal and by supporting renewable energy production.

“In the time ahead, there will be more available capacity in pipelines and other infrastructure for gas. This means that it is more attractive to explore for gas, and it is important that the industry exploits this opportunity,” says Nyland.

At year-end, there were 83 producing fields on the Norwegian Shelf. One of these – Aasta Hansteen – came on stream in 2018. Simultaneously with start-up of Aasta Hansteen, the Polarled pipeline commenced operation to route gas in to the process facility at Nyhamna in Møre og Romsdal county. Aasta Hansteen and Polarled provide new infrastructure in the northern part of the Norwegian Sea, thus opening up new opportunities in this part of the Shelf.

The companies submitted plans for development and operation (PDOs) for three new projects last year, while nine plans were approved. Seven of the plans relate to field developments linked to existing infrastructure.

“Good exploitation of infrastructure and cooperation across production licences mean lower development costs and make it possible to develop small and medium-sized discoveries in a way that is profitable. This is becoming increasingly important as the Shelf matures.”

Reserves are resources for which development plans have been adopted. Last year, for the first time, reserve growth for oil exceeded the Norwegian Petroleum Directorate’s ambitious curve for reserve growth for the period 2013 - 2023. The reasons for this very positive development are that more fields are being developed and more good work is being done to improve recovery on fields in operation.

Investments on the Norwegian Shelf in 2018 were at approximately the same level as the previous year, but several of the developments that are underway, led by Johan Sverdrup and Johan Castberg, will contribute to substantial growth in 2019.

The industry has done good work on cost control and efficiency in recent years, which has led to a considerable reduction in both exploration, development and operating costs. This is important to ensure that the Norwegian Shelf is competitive and has good resource management.

“A lower cost level is also reflected in the new projects that are approved. These are projects that are profitable for both the companies and the Norwegian society. The general scenario is that the new development projects will be profitable with significantly lower oil prices than the current level,” says Nyland.

Contents on this page

1. Investment and cost forecasts.

- 1.1 Development in cost level.

- 1.2 Overall investment estimate.

- 1.3 Exploration costs.

- 1.4 Operating costs.

- 1.5 Overall estimate for cost development.

2. Increasing oil and gas production in the next five-year period.

3. Further development of a mature shelf.

- 3.1 New developments.

- 3.2 Use of data and new technology for increased value creation.

- 3.3 The IOR award.

- 3.4 Increased growth in reserves.

- 3.5 Player landscape for fields.

4. Exploration activity.

- 4.1 More exploration wells.

- 4.2 Exploration for gas.

- 4.3 Significant interest in the Norwegian shelf.

- 4.4 Discoveries in 2018.

- 4.5 Undiscovered resources.

- 4.6 Seabed minerals.

- 4.7 Storage of CO2 on the Norwegian shelf.

1 - Investment and cost forecasts

For 2019, investments are expected to reach over 140 billion kroner (excluding exploration), an increase of 13 per cent compared with 2018. Many ongoing projects, both new field developments and on operating fields, contribute to a relatively stable activity level. After 2019, a decline in investments is expected towards 2022. The investment level in new fields through the 2020 decade is largely also dependent on new, major discoveries. Exploration costs are expected to increase by 10 per cent from 2018 to 2019, after which we see a moderate reduction for the next few years.

The portfolio of new major development projects is reduced, and the addition of new discoveries in recent years has been less than before. This is an important reason for reduced investment activity after 2019. Resource growth from new discoveries and maturing of new projects on producing fields will be important to maintain the activity level over the longer term.

1.1 Development in cost level

The industry has completed comprehensive work on cost control and efficiency, which has led to a considerable reduction in both exploration, development and operating costs. This is an important measure to ensure that the Norwegian Shelf is competitive, and has good resource management. The development in well costs is one example of this. Average costs per development well have fallen by more than 40 per cent from 2014 to 2018, cf. Figure 1-1.

A lower cost level is also reflected in the profitability of new projects that are approved. These are projects with good profitability for both the companies and the Norwegian society. The general scenario is that new development projects have good profitability and will be robust with significantly lower oil prices than the current level.

Figure 1-1

Development in average well investments per development well (excl. Troll), estimate for 2018

The NPD’s forecasts assume a weak real growth in the cost level in the time ahead. It is important that the companies maintain focus on cost control in order to realise new projects, both new field developments and projects on operating fields. This is underlined not least by oil price fluctuations in recent months. The industry itself has pointed to a number of sources for further cost reduction. A moderate cost level is a precondition for developing profitable projects in the years to come.

1.2 Overall investment estimate

Investments levelled out in 2018 at around 125 billion kroner (Figure 1-2). Several ongoing field developments, led by Johan Sverdrup and Johan Castberg, will contribute to substantial growth in investments in 2019. In 2019, investments are expected to be in excess of 140 billion kroner, a growth of 13 per cent from 2018.

Figure 1-2

Investments excluding exploration, forecast for 2018-20231

1 Operating fields are divided into two categories in order to highlight the fact that parts of the investments are linked to commissioning of field developments for fields that have recently come on stream (fields that came on stream 2015-2018).

There is considerable activity on operating fields, and several development projects and upgrades contribute to investment growth in 2019. The platform on Njord is being upgraded, and recovery from the Snorre field will be increased through the Snorre Expansion subsea development. Other major projects to improve recovery on operating fields include Valhall West Flank where a new wellhead platform will be installed, and investments in new wells and subsea facilities on Troll (Phase III). In addition to these projects, generally high drilling activity on operating fields is expected in the next few years.

Investments of between 110-115 billion kroner are expected in 2022 and 2023. After the commissioning of major projects such as Johan Sverdrup and Johan Castberg, the NPD sees limited new major development projects that can help to lift the investment level in the years after 2019.

Figure 1-3 shows overall investments in ongoing and new field development projects, and illustrates the significance of Johan Sverdrup and Johan Castberg, both for the high investment level in 2019, but also for the reduction in investments in the 2020-2022 period.

Figure 1-3

Overall investments in ongoing and new field development projects

Other ongoing developments that will contribute significant investments in the next few years are commissioning of Martin Linge and the subsea developments Fenja (to Njord) and Nova (to Gjøa).

It must be emphasised that the exact timing for start-up of new field development projects will always be uncertain. The start-up of individual projects can be accelerated or delayed. From 2020, new development projects for discoveries will account for an increasing share of the total investments. This contributes to greater uncertainty surrounding the investment estimates.

The investments from 2020 and forward are somewhat lower than the estimate presented in The Shelf in 2017. This is due e.g. to postponement of certain new field development projects and lower investment estimates for specific developments.

While investments in new fixed and floating facilities will experience significant decline in the years to come, investments in new development wells are expected to increase. (Figure 1-4). The NPD does not expect as many developments with new stand-alone facilities in the next few years. Commissioning of projects such as Johan Sverdrup, Johan Castberg and Martin Linge explain the decline in investments in fixed and floating facilities.

Figure 1-4

Investments excluding exploration, various investment categories, forecast for 2018-2023

Three development plans were submitted for approval by the authorities in 2018: Nova, Troll Phase 3 and Johan Sverdrup construction phase 2.

It is expected that several projects will be approved in the next couple of years. This applies, for example, to new field developments such as 16/4-6 S (Luno II), 30/11-8 S (Krafla) and 36/7-4 (Cara). The NPD also expects investment decisions for redevelopment of older fields such as Tor and Hod.

At year-end, the discovery portfolio contains 85 discoveries. Despite the fact that most of these discoveries are expected to be profitable from an economic standpoint, there are a number of factors that could result in it taking some time before development decisions are made. Among other things, that most of the discoveries are expected to be developed as subsea fields tied in to existing infrastructure. These discoveries therefore depend on available process capacity on the relevant host facilities before development can be approved. Many of the discoveries have recoverable gas resources. Access to available capacity in the gas infrastructure can also entail that licensees will wait to make development decisions.

A number of investment decisions are expected on operating fields that will lay the foundation for maintaining production and extending field lifetime. However, these projects are not as large as the development projects that have been approved on operating fields in recent years.

1.3 Exploration costs

There has been a marked increase in both the number of exploration wells and in exploration costs from 2017 to 2018. In 2018, 53 exploration wells were spudded at a total cost of about 25 billion kroner (Figure 1-5)2. In comparison, 36 exploration wells were spudded in 2017, and exploration costs amounted to 20 billion kroner. Based on the companies’ plans, approximately the same number of exploration wells will be drilled in 2019, as in 2018. Toward the end of the period, a moderate reduction in the number of exploration wells and exploration costs is assumed. The forecast is slightly higher than the estimate presented in The Shelf in 2017. The main reason for this is that the new forecast presumes the drilling of more wells.

Figure 1-5

Estimated exploration costs, forecast 2018-2023

2 Exploration costs comprise both company and licence-related exploration costs, cf. Figure 1-5. The company-related exploration costs often accrue before the production licence is awarded, for example costs associated with buying and interpreting seismic data. However, most of the exploration costs accrue after award of the production licence. Of these, drilling exploration wells is the dominant cost item.

1.4 Operating costs

83 fields were producing at the end of 2018, in addition to operation of pipelines and land facilities. The total costs associated with operation of the infrastructure amounted to 58 billion kroner in 2017 (Figure 1-6). Following a period of reduction, operating costs are now expected to level off. In isolated cases, the start-up of new fields, particularly Johan Sverdrup, Johan Castberg, Martin Linge and Yme (with leased production facility) will contribute to increased operating costs. The increase from these fields will be partially offset by fields that are shut down.

Figure 1-6

Operating cost forecast specified by field status – forecast 2018-2023

1.5 Overall estimate for cost development

Figure 1-7 shows the overall forecast for operating costs, investments, exploration costs, shutdown and disposal costs, and other costs. The ‘other costs’ category includes certain minor items, such as concept studies and preparations for operation.

The costs associated with shutdown and disposal are expected to be low in the next few years. Some fields plan to cease production within a timeframe of five years. These are largely subsea fields where this type of cost is limited. Costs will also accrue in connection with shutdown and removal of certain facilities on fields that will remain in operation.

Total costs in 2018 were around 220 billion kroner. As a consequence of higher investments and exploration costs, total costs will increase from 2018 to 2019. Despite a decline in investments from 2019, the activity level will remain high, viewed in a historical perspective.

Figure 1-7

Total costs – forecast for 2018-2023

2 - Increasing oil and gas production in the next five-year period

The Norwegian Petroleum Directorate’s production forecast up to 2023 shows an increase from 2020. Start-up of new fields, including Johan Sverdrup, will more than offset the natural reduction from operating fields. Total production of oil and gas is projected to approach the record year of 2004, with gas accounting for about half. It will be challenging to maintain such a production level up to 2030.

Figure 2-1

Actual and projected sale of petroleum 1971-2023

Preliminary figures show that 226.7 million standard cubic metres oil equivalents (Sm³ o.e.) were sold in 2018. This is 9.5 million Sm³ o.e. or 4 per cent less than in 2017. Gas sales are somewhat reduced and certain oil fields have produced less than expected. Total production of petroleum in 2019 is expected to be 222 million Sm³ o.e.

2.1 Gas

In 2018, 121.7 billion Sm³ gas (119.3 billion Sm³ 40 megajoule gas) was sold. This is a slight reduction from the record level in 2017. The forecast for short-term gas sales (Figure 2-2) shows an expected high and stable level with a slight increase over the next few years.

Figure 2-2

Actual and projected gas sales through 2023

2.2 Oil

A total of 86.2 million Sm³ oil (1.49 million barrels per day) was produced in 2018, compared with 92.2 million Sm³ (1.59 million barrels per day) in the previous year, a reduction of 6.3 per cent.

The forecast for 2018 showed an expected slight decline in oil production compared with the previous year. This decline proved to be greater than expected. This is due, in part, to the fact that certain newer fields are more complex than previously assumed, and certain other fields delivered below the forecast, mainly due to the fact that fewer wells have been drilled than expected.

For 2019, we estimate that oil production will be reduced by an additional 4.7 per cent, to 82.2 million Sm³ (1.42 million barrels per day). Production is expected to show a substantial increase in 2020, e.g. as a consequence of Johan Sverdrup. The uncertainty in the production forecasts is mainly linked to the drilling of new wells, start-up of new fields, the ability of the reservoirs to deliver and regularity for producing fields.

Production from operating fields and approved projects accounts for 90 per cent of expected production in the five-year period 2019-2023 (Figure 2-3). The remaining ten per cent are primarily expected to come from improved recovery measures on the fields. Wells that have not yet been approved and optimisation of recovery strategies are the main contributing factors. Towards the end of the five year period, production is also expected from discoveries which do not yet have a firm development decision.

Figure 2-3

Oil production 2014-2023 distributed by maturity

Table 2-1 Production forecast distributed by the various products for the next five years

2.3 Total production up to 2030

Production will remain relatively high over the next decade and going forward to 2030, production from undiscovered resources is expected to have increasing significance.

Figure 2-4 shows the most recent production forecast compared with what was presented one year ago, in The Shelf in 2017. The forecast reveals a relatively flat production development up to 2020. As from that time, it is assumed that all projects currently under development will contribute to a considerable production increase up to 2023.

The production level is somewhat lower in 2019, compared with the previous forecast; approximately unchanged in the period from 2020-2025 and somewhat higher going forward to 2030. The increase in the estimate up to 2030 compared with last year’s forecast, is due in part to the fact that more new measures have been identified on the fields; mainly more wells included in the forecasts.

Figure 2-4

Historical and forecast production 2010 – 2030

3 - Further development of a mature shelf

At year-end, there were 83 producing fields on the Shelf. One new field came on stream during 2018, three new plans for development and operation were submitted and nine plans were approved. Two projects also secured PDO exemptions and three fields were shut down. The figure below shows that the number of fields in production remains high.

Figure 3-1

Number of fields in production through the years

3.1 New developments

Aasta Hansteen on stream

The Aasta Hansteen gas field started producing in 2018 as the first development in the northern part of the Norwegian Sea. The field is situated about 320 kilometres west of Bodø. The water depth in the area is 1270 metres. Never before has a field been developed in such deep water on the Norwegian Shelf.

Simultaneously with start-up of Aasta Hansteen, the Polarled pipeline commenced operation to route gas from the field to the process facility at Nyhamna in Møre og Romsdal county, before it is sent on to Europe. Aasta Hansteen and Polarled provide new infrastructure in the northern part of the Norwegian Sea, thus opening up new opportunities in this part of the Shelf.

The development solution, which involves a floating cylindrical Spar platform, is the first of its kind in Norway, and the world’s largest. Investment costs for the development are about 37.5 billion kroner.

Figure 3-2

Aasta Hansteen platform

(photo: Equinor)

Development plans submitted in 2018

The authorities received three plans for development and operation in 2018: Johan Sverdrup construction phase 2, Nova and Troll Phase 3.

Johan Sverdrup construction phase 2 is one of the three development plans submitted in 2018. The overall development of this field is the largest industrial project in Norway in a decade. The investments and revenues to the licensees, suppliers and the State will have a major positive impact for society. The plan that is now awaiting approval in the Storting describes the second stage of construction for the field, including expansion of the field centre with a new process platform and installation of five new subsea templates. An area solution for power from land to Johan Sverdrup, Edvard Grieg, Ivar Aasen and Gina Krog will be established as part of the second construction phase.

The investments for the second phase of construction, including the area solution, amount to about 42 billion kroner. Total reserves from the entire field are about 425 million Sm3 oil equivalents, of which about 94 million Sm3 o.e. are linked to the second construction phase. Production start-up for Johan Sverdrup construction phase 1 is planned for 2019, and construction phase 2 is planned in 2022.

Figure 3-3

Johan Sverdrup construction phase 2

(illustration: Equinor)

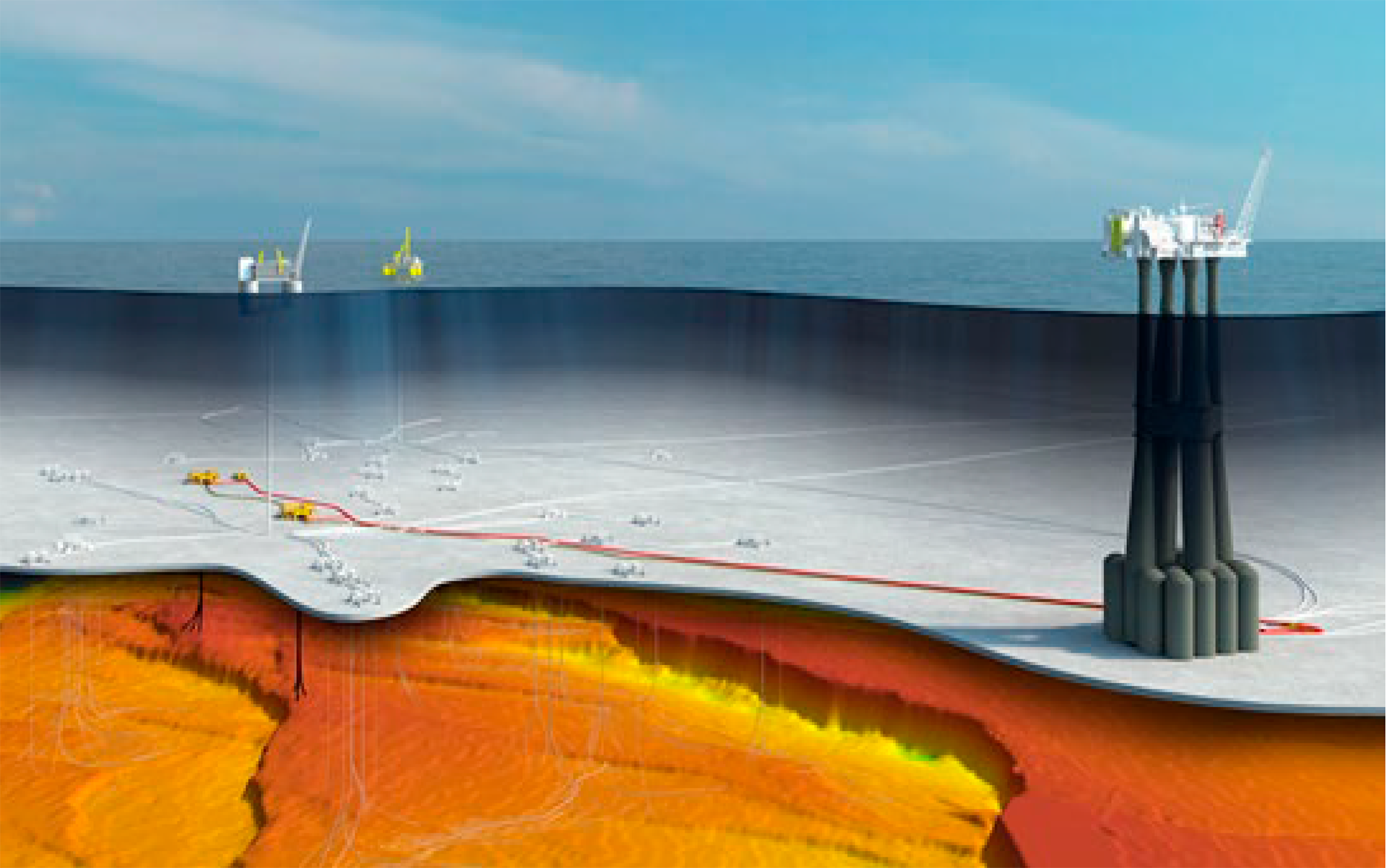

Troll Phase 3 is the last phase of the Troll development, so far, and it relates to production of gas from the gas cap over the oil zone on the western part of the field – Troll Vest. The development plan was submitted and approved in 2018. In addition to being Norway’s largest gas producer, Troll has also been the largest oil producer in recent years. Therefore, it has been important for both the authorities and the licensees to identify the right time and the right level of gas production from Troll Vest, without adversely affecting oil recovery. The gas reserves in Troll Phase 3 amount to about 360 billion Sm3 of a total of around 1425 billion Sm3 recoverable gas reserves in the entire field.

Troll Phase 3 will be developed in several stages, of which only the first stage was included when the development plan was submitted. In the first phase, two subsea templates will be installed and eight production wells will be drilled. The gas will be sent to Troll A for processing and compression before further transport to the process facility at Kolsnes. Investments for the first stage of Troll Phase 3 are nearly 8 billion kroner. The project is very profitable and will generate significant values.

Figure 3-4

Troll Phase 3

(illustration: Equinor)

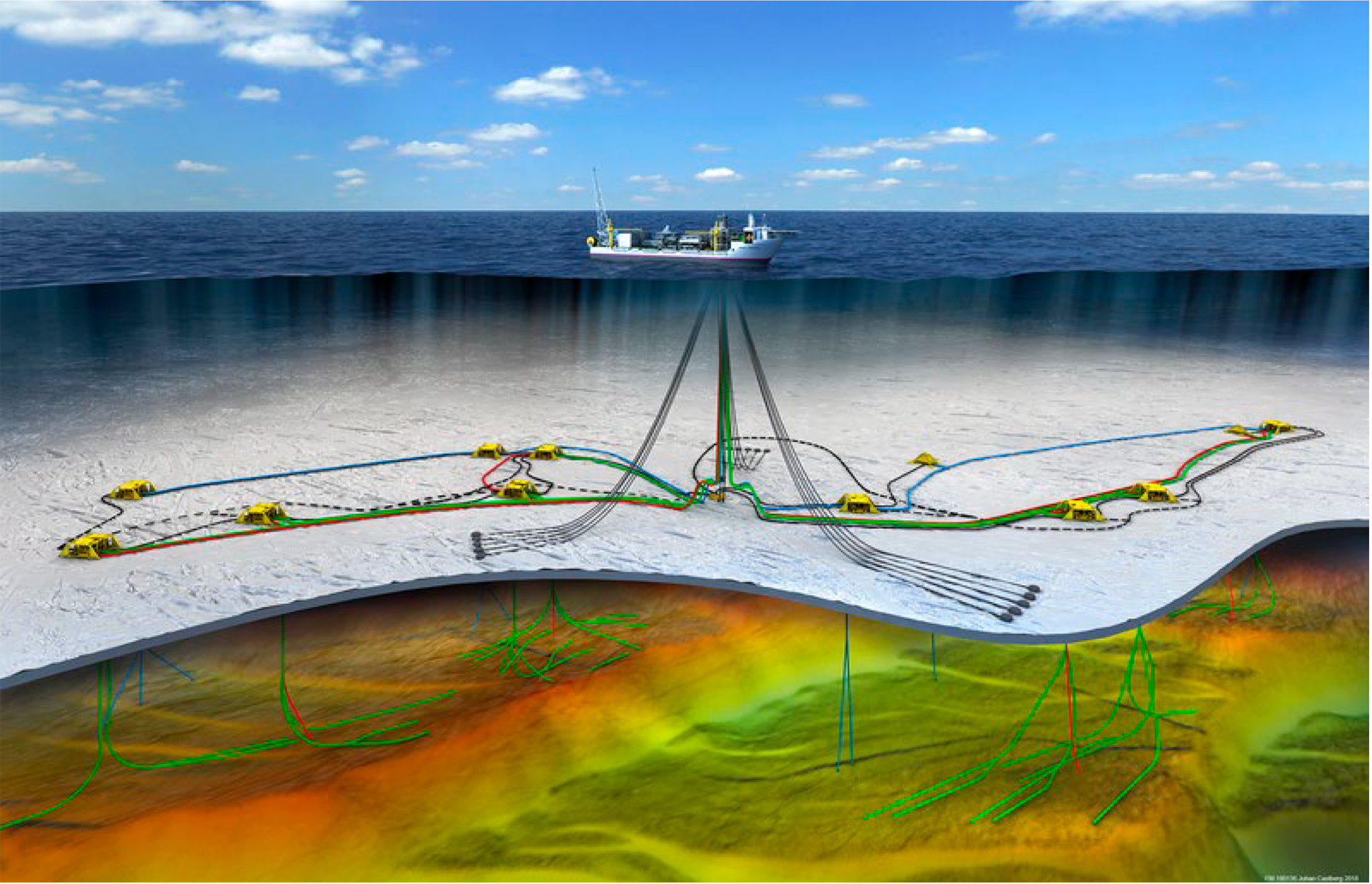

The third development plan submitted to the authorities in 2018 relates to the Nova subsea development in the northern part of the North Sea, southwest of Gjøa. The field is located in a mature area, and will be tied in to existing infrastructure on Gjøa. The field can thus make use of available capacity for a cost-effective development. The selected development solution entails installation of two subsea templates.

Total reserves for the Nova development are around 12 million Sm3 o.e., and projected investments are about 10 billion kroner.

Approved development plans and use of new and existing infrastructure

The authorities approved nine development plans in 2018. Among these, we find both field developments tied to existing infrastructure and stand-alone developments. Two plans describe stand-alone developments and seven of the plans relate to developments tied in to existing infrastructure. PDO exemptions were also granted for projects on Gullfaks and Fram, respectively.

The many tie-ins to existing infrastructure show that available capacity in accessible infrastructure enables profitable development of small and medium-sized discoveries. Cooperation across production licences and good exploitation of existing infrastructure mean lower costs for new developments. This is becoming increasingly important as the Shelf matures. Such development solutions also contribute to increase recovery and extend the lifetime of the host field. Development of satellite fields is therefore extremely important for future value creation.

Table 3-1 Approved development plans in 2018

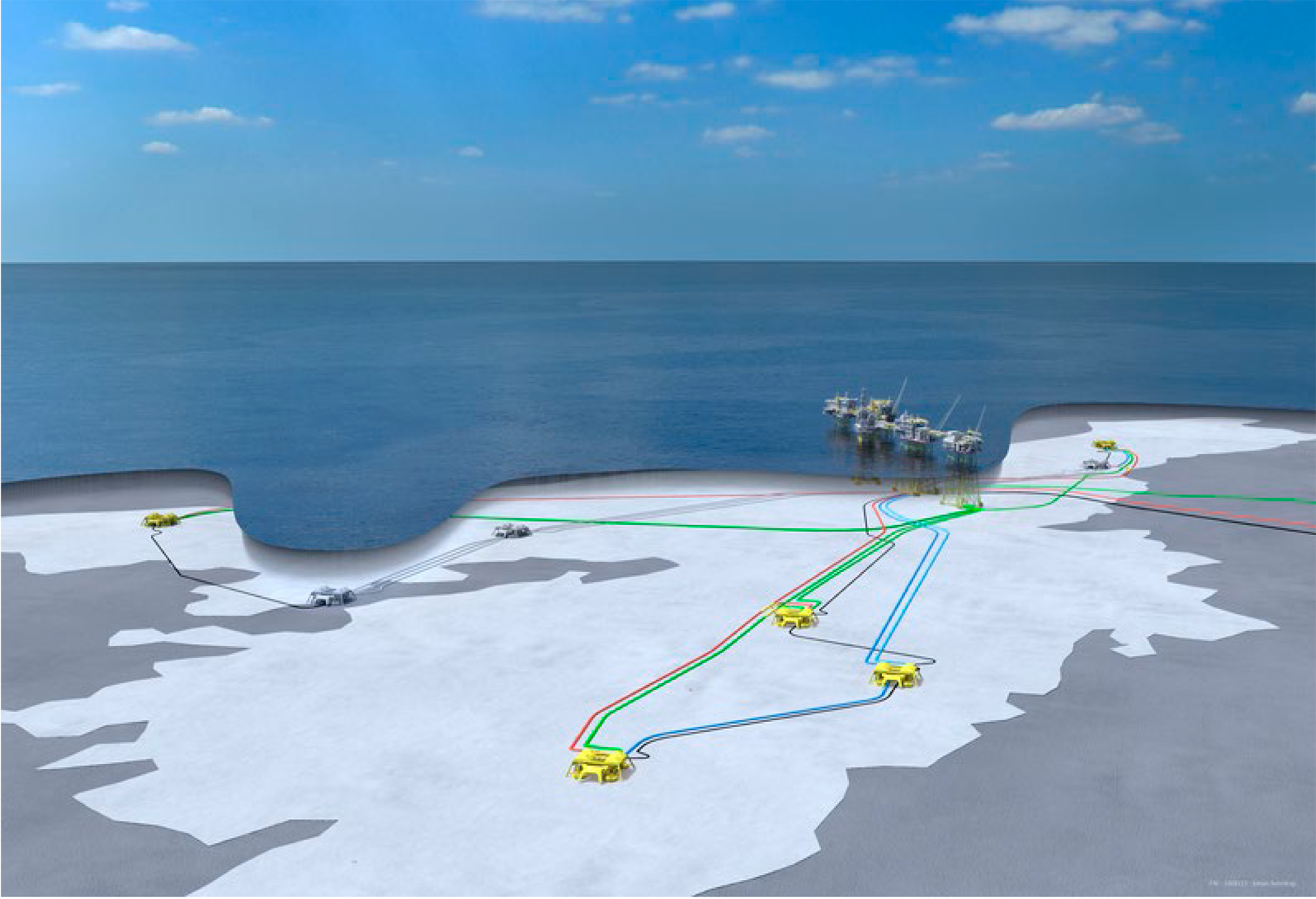

One of the new stand-alone developments is Johan Castberg, the third field to be developed in the Barents Sea. In the planning phase, the NPD has been focussed on flexibility in the development concept so as to have the capability to phase in new discoveries in the area. The development solution that was selected safeguards this consideration. Several minor discoveries have since been made in the area that can be tied in to the field, such as the Skruis discovery, proven in the autumn of 2018.

Figure 3-5

Johan Castberg

(illustration: Equinor)

Njord is an example of an old field that has had its lifetime extended. The facilities will be upgraded at a cost of about 16 billion kroner. Njord is the host field for Hyme and will become the host field for the new Bauge and Fenja developments. The development plan for the latter field was approved in 2018. The development in the area around Njord illustrates the importance of cooperation across production licences to allow for development of minor discoveries with different licensees than the host field. This also highlights the importance of maintaining today’s facilities with a view to future use, and exploitation of existing infrastructure.

Figure 3-6

The Njord platform

(photo: Equinor)

3.2 Use of data and new technology for increased value creation

The Norwegian Petroleum Directorate works to ensure that all socio-economically profitable resources are produced. To achieve this, different improved recovery measures must be tested on the fields, both on operating fields and in new developments. We believe that better understanding of the subsurface and testing and implementing new technology entails substantial potential value.

Several improved recovery methods have been tested in 2018, including a new type of seabed technology for injection of seawater on Ekofisk, and new drilling and well technology to increase production from tight reservoirs on Ekofisk and Valhall. Results from these tests provide important data and knowledge that contribute to further development and use of these of these technologies.

It is often the large fields with good economy that have an opportunity to be the first to try out new methods. Johan Sverdrup is a good example of this, as the field is expected to try out polymer injection as a method to improve oil recovery. This is important so as to chart the potential for an increase of recoverable reserves from the field.

Test production is an example of data acquisition to reduce uncertainty. The development plan for Ærfugl was approved in 2018, following a period of test production. The test production contributed to reduce reservoir uncertainty, thus making it easier to e.g. estimate the number of wells and where they should be placed. Test production has taken place in 2018 on the Alta discovery in the Barents Sea. The objective was to test oil production rates over a longer period of time in various carbonate rocks without significant breakthrough of water and/or gas. A formation test was also conducted on the Rolvsnes discovery in the North Sea. Both the test production and the formation test yielded positive results. In addition, test production from the Frosk discovery in the North Sea was approved in 2018. Test production and testing of flow properties can be important in reducing the uncertainties in future developments.

The Konkraft report, “Competitiveness – changing tide on the Norwegian continental shelf”, published in early 2018, highlights the importance of collecting and managing data, as well as the significance of sharing data. New methods and new technology for acquiring and storing large volumes of data and new methods for advanced data processing also make it possible to use this data better. It is important that these opportunities are used to ensure better exploitation of the petroleum resources.

3.3 The IOR award

In an effort to inspire the players to implement measures to improve recovery, the Norwegian Petroleum Directorate awards an improved recovery prize – the IOR award – every other year. In 2018, the prize was awarded to the owners of the Alvheim field, with its operator Aker BP and partners ConocoPhillips and Lundin.

The licensees on Alvheim have shown the willingness to take risks to find and produce more oil in the area. Implementation of newly developed technology, sharing data and the ability to see the area as a whole have contributed to more than doubling the reserves from Alvheim since the plan for development and operation was approved.

The next IOR prize will be awarded at ONS in 2020.

3.4 Increased growth in reserves

Reserves are resources for which development plans have been adopted. There is steady growth of oil reserves on the Norwegian Shelf. In 2018, for the first time, reserve growth exceeded the Norwegian Petroleum Directorate’s ambitious curve for reserve growth for the period 2013 - 2023. The reasons for this very positive development in reserves are that more fields are being developed and more work is being done to improve recovery on fields in operation. This shows that both the authorities and the industry do good work to further develop the Shelf. It is important that this work continues in order to maintain reserve growth.

Figure 3-7

Reserve growth for oil

3.5 Player landscape for fields

The distribution of production between companies on the Norwegian Shelf has varied over time. Many new companies have come over the last ten years, and there have been several acquisitions and mergers. This has contributed to increased diversity and new ways of working. Major international companies have sold ownership interests and operatorships, but they remain an important presence on the Shelf and are responsible for a large percentage of the production. We also see the emergence of new medium-sized oil companies whose primary focus is the Norwegian Shelf. This diversity of companies is important if we are to exploit all the various business opportunities found on the Shelf. This is a welcome and positive development. At the same time, a continued active and competent Equinor is essential if we are to achieve petroleum policy goals.

Figure 3-8 shows the development in production distribution, divided between European gas and power companies, small and medium-sized companies and major international companies. Equinor and Petoro, which account for around 60 per cent of the production throughout the entire period, are not included in the figure.

Figur 3-8

Ownership distribution of production from the Norwegian Shelf (excluding Statoil/Equinor and Petoro) distributed by type of company

Figure 3-9 shows the development in the number of field operators since 2000. It shows that we have gained more new operators over the last decade, including several medium-sized companies.

Figure 3-9

Field operators

4 - Exploration activity

Exploration activity in 2018 has been considerably higher than in the two previous years. The number of exploration wells has increased dramatically, and 87 new production licences were awarded, which is a new record.

Figure 4-1

Exploration wells and production licences awarded in 2018

4.1 More exploration wells

A total of 53 exploration wells were spudded in 2018, an increase of as many as 17 wells from 2017. Based on the companies’ plans so far, this number is expected to remain at the same high level in 2019.

There are several reasons for the increased exploration activity. In recent years, large parts of the Shelf have been covered with new and improved seismic data. This has enabled the industry to define new exploration prospects, and resulted in extensive awards in the licensing rounds. At the same time, reduced cost levels and increasing oil prices have improved exploration profitability.

Most of the wells drilled in 2018 were drilled in the North Sea. Many more wells were drilled in the North Sea and the Norwegian Sea than in 2017, while there has been a decline in the Barents Sea. Of these 53 wells, 28 are wildcat wells and 25 are appraisal wells.

Figure 4-2

Spudded exploration wells, 2019 is an estimate

27 wildcat wells were completed in 2018, and these have resulted in 11 discoveries, yielding a discovery rate of 44 per cent3. The discoveries have a preliminary total estimate of 82 million Sm3 recoverable oil equivalents (o.e.). This yields an anticipated resource growth that is higher than each of the three previous years.

Resource growth at this level is not sufficient to maintain production of oil and gas at a high level after 2025. Therefore, it is essential that more profitable resources are proven in the next few years.

3 Two wildcat wells that were not completed («junked») due to technical problems are not included in the discovery rate.

4.2 Exploration for gas

Norway is an important long-term supplier of gas to Europe. Gas can contribute to more sustainable development in three ways: by providing reasonable and stable access to energy, by displacing use of coal and by supporting renewable energy production. Norwegian gas also represents substantial values for the Norwegian society.

Proximity to the market, low transport costs and an integrated and flexible transport system make Norwegian gas resources very competitive in Europe.

Today, Norwegian gas production is at plateau level. As time goes on, declining production from the major fields must be replaced by discoveries that have not yet been made. New capacity is available in Polarled, and capacity will also gradually become available in other parts of the infrastructure. This means that it will be more attractive to explore for gas, and it is important that the industry exploits this opportunity and intensifies its search for gas.

New gas resources will contribute to maintaining production over the longer term, and to curbing unit costs in the infrastructure. High production and efficient exploitation of the infrastructure makes it possible to maintain production while also keeping transport costs low. This will contribute to utilisation of a larger percentage of the gas resources.

The Norwegian Petroleum Directorate expects that nearly two-thirds of the gas resources that have not yet been discovered are located in the Barents Sea. This underlines the importance of the Barents Sea for long-term gas production. Today’s gas transport capacity from the Barents Sea is limited to the LNG plant at Melkøya which, according to plan, will be fully utilised until the beginning of the 2040 decade. If the companies do not explore for gas, it will also be more difficult to find sufficient resources to justify new gas infrastructure.

4.3 Significant interest in the Norwegian shelf

The authorities facilitate predictable and stable framework conditions, and active award of acreage. The industry exhibits significant interest in the Norwegian Shelf, which is reflected in the number of applications for exploration acreage and awards in the recent licensing rounds. In APA 2017 (Awards in Predefined Areas), which were awarded in early 2018, 75 new production licences were awarded to 34 companies. Of the 75 production licences, 45 are in the North Sea, 22 in the Norwegian Sea and 8 in the Barents Sea.

In June 2018, 12 new production licences with a total of 47 blocks were awarded to 11 companies in the 24th licensing round; 9 blocks in the Norwegian Sea and 38 in the Barents Sea.

The authorities are now working with the applications to APA 2018 and awards are expected in the new year. 38 companies submitted applications. Most of the companies that are active on the Norwegian Shelf applied, and applications have also been received from companies that are new to the Shelf.

While interest has been greatest in the North Sea and the Norwegian Sea, we must look back to 2007 to find greater interest in the Barents Sea in an APA round.

Figure 4-3

Production licences awarded since 2000

4.4 Discoveries in 2018

Eleven discoveries were made in 2018. Of these, three are in the Barents Sea, two in the Norwegian Sea and six in the North Sea.

The largest discoveries are 6604/5-1 (Balderbrå) and 6506/11-10 (Hades/Iris) in the Norwegian Sea. Both can have significant upsides, and delineation of Hades/Iris is expected in 2019.

Figure 4-4

Discoveries in 2018

In The North Sea, 30 exploration wells were completed in 2018, 13 of which are wildcat wells. Activity has increased dramatically here compared with 2017.

Six discoveries were made, the largest was Aker BP’s 24/9-12 S (Frosk) oil discovery in injectite sands from the Paleocene Age. This is located close to the Alvheim field, and the licensees are considering tying the field to the infrastructure there. Three oil discoveries were also made in the area north of the Troll field: 35/9-14 (Tethys), 35/12-6 S (Kallåsen) and 35/10-4 A (Gnomoria). The 30/6-30 (Rungne) gas and condensate discovery was proven just north of the Oseberg field, and the 16/1-29 S (Lille Prinsen) oil and gas discovery was proven north of the Ivar Aasen field. There are no clarified development solutions for these discoveries at this time, but they are being considered for development together with other discoveries in the area.

Several appraisal wells were also drilled with positive results. For example, the volume estimate for the 35/12-2 (Grosbeak) gas discovery northeast of the Fram field increased by about 13 million Sm3 recoverable o.e., which is more than a doubling.

In The Norwegian Sea, 13 exploration wells were completed in 2018, considerably more than in the two previous years. Eight of these were wildcat wells, which resulted in two discoveries.

In well 6604/5-1 (Balderbrå), west of Aasta Hansteen, Wintershall proved gas in the Nise formation from the Late Cretaceous Age. The discovery will be evaluated for tie-in to the Aasta Hansteen facility. OMV found gas and condensate in two levels from the Early Cretaceous and Middle Jurassic in well 6506/11-10 (Hades/Iris), near the Morvin field.

The volume potential of the 6608/10-17 S (Cape Vulture) discovery has been clarified by the drilling of appraisal wells 6608/10 S, A and B, and a development is being considered with tie-in to the Norne field.

In The Barents Sea, exploration activity has been lower than in the record year 2017. This is due to factors such as postponement of several of the planned wells in 2018 to 2019. Eight wells were completed compared with 17 in 2017. Six wildcat wells were drilled, which resulted in three discoveries.

North of the 7324/8-1 (Wisting) discovery, Equinor found gas in well 7324/3-1 (Intrepid Eagle) from the Late Triassic Age. This discovery was among the year’s largest on the Shelf. The well also delineated the 7325/1-1 (Atlantis) discovery, with the result that volumes increased somewhat.

Oil was proven in 7220/5-3 (Skruis), which is a potential additional resource for the Johan Castberg field. Gas was proven in well 7221/12-1 (Svanefjell).

An appraisal well, 7220/11-5 S, was drilled on the Alta discovery. The well was drilled horizontally through the reservoir, with the objective of testing the production properties in carbonate rocks. The test production, which lasted two months, revealed promising results. About 0.1 million Sm3 oil was produced.

Table 4-1: Recoverable resources in new discoveries in 2018.

4.5 Undiscovered resources

The Norwegian Petroleum Directorate updated its estimates for undiscovered resources on the Norwegian Shelf in 2017. Our estimate for undiscovered resources is 4000 million standard cubic metres (Sm3) oil equivalents. This shows that the remaining resources can provide a basis for oil and gas production for many decades to come.

Our resource estimate indicates that nearly two-thirds of the undiscovered resources lie in the Barents Sea. Therefore, this area will be important for maintaining production over the longer term.

The NPD acquired seismic in the Barents Sea in the period from 2012 to 2017. This work will continue in 2019, and the Storting (Norwegian Parliament) has allocated funds for mapping an area in the northeastern part of the Barents Sea, near the Russian border.

4.6 Seabed minerals

After the Ministry of Petroleum and Energy was delegated administrative responsibility for the mineral deposits on the Shelf in 2017, the NPD was assigned the task of mapping the resource opportunities.

Over the course of several research expeditions, the NPD has taken samples of both iron-manganese crusts and massive sulphide deposits. The deposits are found in the deeper parts of the Norwegian Sea and along the Mid-Atlantic Ridge. There may be important industrial metals here, such as copper, zinc, cobalt, nickel, vanadium, wolfram and silver, in water depths between 800 and 3000 metres. These metals play an important role in e.g. electric vehicles, wind turbines and mobile phones.

A four-week expedition was carried out in 2018 on the Mohns Ridge. Several types of geophysical data were collected using an autonomous underwater vehicle (AUV). Sulphide samples were collected with a remotely operated vehicle (ROV). This data will now be interpreted and the mineral samples will be analysed.

Figure 4-5

Map of the Norwegian Continental Shelf.

Areas where the NPD has collected data and mineral samples are marked with stars.

The NPD plans similar data acquisition activities in the years ahead.

4.7 Storage of CO2 on the Norwegian shelf

In July 2018, for the first time ever, the Ministry of Petroleum and Energy announced a licensing round for injection and storage of CO2 under the seabed. Equinor with its partners Shell and Total in the Northern Lights project, submitted an application for an exploitation permit for a subsea reservoir in September.

The goal is to realise a cost-effective solution for full-scale CO2 capture and storage in Norway, given that this will lead to technology development in an international perspective, cf. Prop. 85 S (2017-2018).

According to plan, the exploitation permit will be awarded in 2019.

Updated: 30/01/2019